| Accountancy NCERT Notes, Solutions and Extra Q & A (Class 11th & 12th) | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 11th | 12th | ||||||||||||||||||

Chapter 1 Introduction To Accounting Concepts, Solutions and Extra Q & A

Accounting is the systematic process of identifying, measuring, and communicating an organisation's economic information to permit informed judgments and decisions. Often called the language of business, its fundamental purpose is to provide reliable financial data to various users, moving far beyond its traditional role of mere record-keeping.

Reflecting this evolution, the accountant's role has shifted from a passive recorder to a vital member of the decision-making team. This transformation has opened exciting new growth areas like forensic accounting, e-commerce, and environmental accounting, where specialised financial information is crucial for strategy and operations.

This introductory chapter, therefore, delves into the fundamental nature, critical need, and expansive scope of accounting in this modern context. It will explore the objectives of accounting, its qualitative characteristics, and define the basic terminology that forms the foundation for understanding this indispensable business discipline.

Meaning and Definitions of Accounting

Accounting is a systematic and comprehensive process of financial reporting for a business entity. Its primary purpose is to provide quantitative information, mainly financial in nature, that is intended to be useful in making economic decisions. The definition of accounting has evolved over time, shifting from a narrow procedural focus to a broader, user-oriented perspective.

Evolving Definitions of Accounting

Several professional bodies have defined accounting, with each definition reflecting the economic and business environment of its time.

American Institute of Certified Public Accountants (AICPA), 1941

In 1941, the AICPA defined accounting as: "the art of recording, classifying, and summarising in a significant manner and in terms of money, transactions and events which are, in part at least, of a financial character, and interpreting the results thereof."

This definition emphasizes the procedural aspects of accounting—the steps involved in processing financial data from recording to interpretation.

American Accounting Association (AAA), 1966

With greater economic development, the role and scope of accounting broadened. In 1966, the AAA provided a more user-focused definition: "the process of identifying, measuring and communicating economic information to permit informed judgments and decisions by users of information."

This definition highlights the ultimate purpose of accounting: to communicate information for decision-making.

A Modern, Comprehensive Definition

Synthesizing these perspectives, accounting today can be defined as:

"The process of identifying, measuring, recording, and communicating the required information relating to the economic events of an organisation to the interested users of such information."

To fully appreciate this definition, we must understand its key components.

Key Components of the Accounting Process

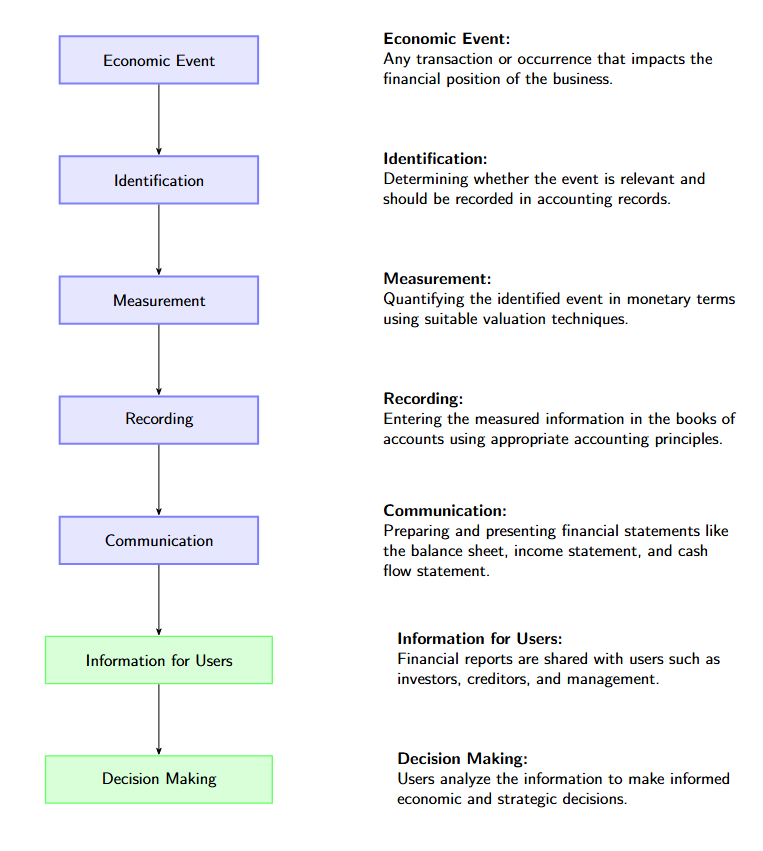

The modern definition of accounting can be broken down into four essential and interconnected aspects. The entire process is designed to convert raw financial data into meaningful information.

1. Economic Events

An economic event is a happening of financial consequence to a business organisation. It consists of transactions that are measurable in monetary terms. For example, the purchase and installation of new machinery is an event, which comprises several individual financial transactions such as the purchase price, transportation costs, and installation charges.

Economic events can be classified as:

External Events: These are events that involve transactions between the organisation and an outside party. Examples include:

Sale of goods to a customer.

Purchase of raw materials from a supplier.

Payment of rent to a landlord.

Internal Events: These are economic events that occur entirely within the organisation, between its internal departments. Examples include:

Supply of materials from the stores department to the production department.

Recording depreciation on a fixed asset.

2. Identification, Measurement, Recording, and Communication

This four-stage cycle represents the functional core of accounting.

Identification: This is the first step, where one determines which events to record. It involves observing activities and selecting only those events that are of a financial character and relate to the organisation. For instance, the sale of goods for ₹10,000 is identified and recorded, but the appointment of a new CEO, while important, is not recorded as it lacks a monetary value.

Measurement: This step involves quantifying the identified transactions in a common monetary unit, such as the Indian Rupee (₹). If an event cannot be quantified in monetary terms, it is not recorded in the financial books.

Recording: Once an economic event is identified and measured, it is recorded in the books of account in a chronological order. This systematic recording is the "book-keeping" phase of accounting and ensures a complete and permanent record.

Communication: This is the final and most crucial step. The recorded information is summarised and presented in the form of accounting reports (e.g., Profit & Loss Account, Balance Sheet) and communicated to the users. The goal is to provide the right information to the right person at the right time.

3. Organisation

Organisation refers to any business enterprise for which accounting records are maintained. For accounting purposes, an organisation is treated as a separate entity from its owners. It can be established for profit-making or not-for-profit motives. Examples include:

Sole-Proprietorship Concerns

Partnership Firms

Companies (e.g., ITC Limited)

Co-operative Societies

Not-for-Profit Organisations (e.g., trusts, NGOs)

4. Interested Users of Information

Accounting information is required by many different groups to make important decisions. These users are broadly classified into two categories:

Internal Users: These are individuals within the organisation who are involved in managing and operating the business. They include the Chief Executive, Financial Officer, Business Unit Managers, and other employees who need detailed and timely information for planning, controlling, and evaluating performance.

External Users: These are individuals and organisations outside the business who have a direct or indirect interest in its financial affairs. They include investors (to assess risk and return), creditors (to assess creditworthiness), tax authorities (for tax compliance), and customers (to assess long-term viability).

The Need for Accounting Information: Users and their Requirements

Accounting is necessary because many different groups of people need financial information to make important decisions. These users can be broadly divided into two categories: internal users and external users.

Internal Users

Internal users are the individuals within the organisation who are responsible for planning, controlling, and running the business. Their information needs are often detailed and frequent.

Management (e.g., CEO, Financial Officers, Plant Managers): They need timely information on costs, profitability, and efficiency to plan for the future, control operations, and make strategic decisions like setting prices, launching new products, or investing in new machinery.

Employees and Labour Unions: They are interested in the stability and profitability of the business to assess job security, the potential for future wage increases, and bonus payments.

External Users

External users are individuals or organisations outside the business who have a direct or indirect financial interest. They rely on the published financial statements as they do not have direct access to the detailed internal records.

Investors and Potential Investors: They need information to assess the risks and returns of investing in the company. Their decisions to buy, hold, or sell shares depend on the company's past performance and future prospects.

Creditors (e.g., Banks, Lenders, Suppliers): They need information to determine the company's creditworthiness and its ability to repay loans and interest on time. Suppliers use this information to decide whether to grant credit for goods.

Government and Tax Authorities: They require information to assess tax liabilities (like GST and Income Tax) and to ensure the company is complying with regulations (e.g., Companies Act, SEBI guidelines).

Customers: They have an interest in the company's long-term viability, especially if they rely on it for a continued supply of products, spare parts, or after-sales service and warranties.

Public and Social Responsibility Groups: This group is interested in the company's contribution to the economy and its impact on the environment and society, such as employment generation and environmental protection measures.

History and Development of Accounting

Accounting enjoys a remarkable heritage, with a history as old as civilisation itself. The need to record transactions, track wealth, and ensure accountability is a fundamental human requirement that has existed for millennia. The evolution of accounting from simple notations on clay tablets to the complex global information system it is today mirrors the development of commerce, governance, and society.

Ancient Civilizations: The Seeds of Record-Keeping

The earliest seeds of accounting were likely sown in the fertile crescent. Around 4000 B.C., the ancient civilisations of Babylonia and Egypt developed systems to record transactions. They used clay tablets to track the payment of wages and the collection of taxes, essential functions for managing their burgeoning states and massive construction projects.

Historical evidence reveals that the Egyptians used a sophisticated form of accounting for their royal treasuries. Officials in charge of gold and other valuables had to send day-wise reports to their superiors, known as Wazirs (the prime minister), who in turn compiled month-wise reports for the king. Similarly, Babylonia, known as the "city of commerce," used accounting not just for records but also to uncover losses arising from fraud and inefficiency.

In Greece, accounting was used to manage public finances, apportioning revenues among treasuries and maintaining detailed records of receipts, payments, and balances. The Romans (from 700 B.C. to 400 A.D.) used a memorandum or daybook to record daily receipts and payments, which were then posted to ledgers on a monthly basis. In the East, China had developed a sophisticated form of government accounting as early as 2000 B.C.

Accounting in Ancient India

Accounting practices in India can be traced back over twenty-three centuries. During the reign of the Mauryan Emperor Chandragupta, his chief minister, Kautilya, wrote the famous treatise 'Arthashastra'. This book, a guide on statecraft and economic policy, also described in detail how accounting records were to be maintained for the kingdom. It laid out rules for tracking revenue, expenditure, and managing the state treasury, highlighting a clear understanding of the importance of financial control in governance.

The Advent of Double-Entry: Luca Pacioli

The most significant leap in accounting history came during the Renaissance in Italy. Luca Pacioli, a Franciscan friar and a contemporary of Leonardo da Vinci, is widely regarded as "The Father of Modern Accounting". In 1494, in Venice, he published his seminal work, "Summa de Arithmetica, Geometria, Proportioni et Proportionalita" (Review of Arithmetic and Geometric Proportions).

While Pacioli did not invent the double-entry system, his book was the first to codify and describe the method used by Venetian merchants. He effectively spread the knowledge of double-entry book-keeping across Europe.

In his book, he explained the use of the now-popular terms Debit (Dr.) and Credit (Cr.). He explained their Italian origins:

Debit comes from the Italian debito, which is from the Latin debeo, meaning "owed to" the proprietor or the business.

Credit comes from the Italian credito, from the Latin credo, meaning "trust or belief," representing an amount "owed by" the proprietor or the business.

Pacioli famously wrote, "All entries… have to be double entries, that is if you make one creditor, you must make some debtor." He also detailed the use of the memorandum, journal, and ledger, and emphasized that a merchant's responsibility included being ethical in all business activities.

The Modern Era: Industrial Revolution and Beyond

The Industrial Revolution in the 18th and 19th centuries acted as a major catalyst for the development of accounting. The rise of large-scale factories and corporations created a separation between the owners (shareholders) and the managers of a business. This necessitated more formal and reliable financial reporting to inform owners about the performance of their investments. This period saw the emergence of cost accounting to help managers control production costs and the establishment of the modern accounting profession to provide auditing and assurance services.

Qualitative Characteristics and Disciplines of Accounting

For accounting information to be useful in decision-making, it must possess certain qualities or attributes. These are known as the qualitative characteristics of accounting information. They enhance the understandability and usefulness of financial reports. Furthermore, to cater to the diverse needs of different users, the field of accounting has evolved into several specialized sub-disciplines or branches.

Qualitative Characteristics of Accounting Information

The primary qualitative characteristics that make accounting information decision-useful are Reliability, Relevance, Understandability, and Comparability. These attributes work together to ensure that financial reports are not just a collection of numbers, but a valuable tool for users.

1. Reliability

Reliability implies that the information presented is trustworthy and that users can depend on it. A reliable piece of information is free from error and bias and faithfully represents the economic events it purports to represent. To ensure reliability, information must possess the following qualities:

Verifiability: This means that different knowledgeable and independent observers could reach a consensus that a particular depiction is a faithful representation. For example, the value of a purchased machine can be verified from its purchase invoice.

Faithful Representation: The information must faithfully represent the transactions and events it is meant to portray. For instance, if a company has sold goods worth ₹5 Lakhs, the financial statements should report sales of ₹5 Lakhs.

Neutrality: The information must be free from bias. It should not be presented in a way that is designed to influence a decision in a particular direction.

2. Relevance

Information is considered relevant if it is capable of making a difference in the decisions made by users. To be relevant, information must be available in time to influence decisions and must have predictive or feedback value.

Predictive Value: It helps users form their own predictions about the outcomes of past, present, or future events. For example, past profit information can help in predicting future profits.

Feedback Value: It helps users to confirm or correct their prior expectations. For instance, a profit and loss statement provides feedback on how well the management has performed.

3. Understandability

Understandability is the quality that enables users to interpret and comprehend the information presented in financial statements. The information should be presented in a clear and concise manner. A message is said to be effectively communicated when the receiver interprets it in the same sense in which the sender intended it. This does not mean that complex information should be omitted, but rather that it should be presented as intelligibly as possible.

4. Comparability

Comparability is the quality that allows users to identify similarities and differences between two sets of economic data. This is crucial for making meaningful assessments.

Intra-firm Comparison: Users should be able to compare the financial reports of an enterprise over different time periods to identify trends in its performance and financial position.

Inter-firm Comparison: Users should also be able to compare the financial reports of different enterprises to evaluate their relative performance.

To ensure comparability, accounting policies and reporting formats should be applied consistently from one period to another and across different enterprises.

Disciplines within Accounting (Branches of Accounting)

The increasing scale of operations and the complexity of modern business have led to the development of specialized branches within the accounting discipline. Each branch serves a specific purpose and caters to the information needs of a particular group of users.

1. Financial Accounting

This is the original and most well-known branch of accounting. Its primary purpose is to keep a systematic record of all financial transactions and to prepare financial reports for a specific period. The key objectives are:

To ascertain the profit earned or loss sustained during an accounting period by preparing a Profit and Loss Account.

To determine the financial position of the business at the end of the period by preparing a Balance Sheet.

Financial accounting information is primarily aimed at external users like investors, creditors, and government agencies, though it is also used by management.

2. Cost Accounting

The main purpose of cost accounting is to ascertain and control the cost of products and services. It involves a detailed analysis of all expenditures related to production or service delivery. Its key functions include:

Ascertaining the cost of various products, processes, or services.

Helping in fixing the prices of products and services.

Providing necessary costing information to management for planning, controlling costs, and improving efficiency.

Cost accounting is primarily for the use of internal management.

3. Management Accounting

Management accounting focuses on providing accounting information to assist the management in its decision-making, planning, and controlling functions. It is the most forward-looking of the branches and is not restricted to just financial data. It draws information from both financial and cost accounting and presents it in a way that is most useful for managers. Its scope includes:

Budgeting and forecasting.

Assessing the profitability of different products or departments.

Making capital expenditure decisions (e.g., whether to buy a new machine).

Analysing performance through tools like ratio analysis and cash flow analysis.

Emerging Disciplines

As business and society evolve, new areas of accounting are gaining prominence. These include:

Human Resource Accounting: Focuses on identifying and measuring the value of human resources in an organisation.

Social Accounting (or Social Responsibility Accounting): Involves identifying, measuring, and communicating the social and environmental effects of an organisation's actions.

Forensic Accounting: Uses accounting skills to investigate fraud or financial crimes.

Objectives of Accounting

As a dynamic information system, the fundamental objective of accounting is to provide useful, quantitative financial information to a wide range of interested parties to facilitate rational decision-making. This broad goal is accomplished through several specific, interlinked objectives that guide the entire accounting process from recording transactions to communicating the final results.

1. Maintenance of Systematic Records of Business Transactions

The most basic objective of accounting is to maintain a complete and systematic record of all financial transactions of a business. An enterprise engages in a vast number of transactions every day, such as purchases, sales, receipts, and payments. It is practically impossible for any manager or owner to accurately remember all these varied transactions.

Accounting provides the framework for recording these events in a chronological and orderly manner in the books of accounts. This systematic recording ensures that:

The information is not lost and is available for future reference.

The records can be easily retrieved and analysed.

The recorded information is verifiable and can act as credible evidence in case of any disputes or for legal purposes.

2. Calculation of Profit and Loss

While maintaining records is fundamental, the ultimate goal of any commercial enterprise is to be profitable. Therefore, a crucial objective of accounting is to periodically measure the operational performance of a business. This is done by ascertaining the net profit earned or loss sustained during a specific accounting period (e.g., a financial year, a quarter, or a month). This objective answers the critical question: "How successful were the business's operations over this period?"

The tool used to achieve this is the financial statement known as the Profit and Loss Account or, more commonly today, the Income Statement. This statement acts as a dynamic report that summarises all business activities over a period, contrasting what was earned with what was spent to earn it.

The Core Principle: The Matching Concept

The preparation of the Profit and Loss Account is governed by a fundamental accounting principle known as the Matching Concept. This principle dictates that to determine the true profit or loss for a period, the revenues generated during that period must be matched with the expenses incurred to generate those exact revenues, regardless of when the cash was actually received or paid.

For example, if a company makes a sale in March but receives the cash in April, the revenue is recognised in March. Similarly, if it incurs a salary expense for March but pays it in April, the expense is recorded in March. This ensures that the performance of a specific period is accurately reflected.

Components of the Calculation

The calculation involves two key elements:

Revenues (or Incomes): These are the amounts earned by the business from its primary operating activities. This primarily includes sales of goods or fees from services rendered. It also includes other incomes earned during the period, such as commission received, interest earned on investments, or rent received from property.

Expenses: These are the costs incurred by the business in the process of earning the revenues of that period. They represent the value of assets consumed or services used. Common expenses include the cost of goods sold, salaries and wages, rent, electricity, advertising, interest paid, and depreciation of assets.

The calculation is straightforward:

Profit = Total Revenues - Total Expenses

If Total Expenses exceed Total Revenues, the result is a Loss.

Example: A company generated total sales revenue of ₹6,00,000 in a year. To generate these sales, it incurred the following costs: cost of the goods sold was ₹3,50,000, salaries paid were ₹1,00,000, and rent and other administrative expenses were ₹90,000.

Calculation:

Total Revenues = ₹6,00,000

Total Expenses = ₹3,50,000 (Cost of Goods) + ₹1,00,000 (Salaries) + ₹90,000 (Rent etc.) = ₹5,40,000

Profit = ₹6,00,000 - ₹5,40,000 = ₹60,000

Significance of the Result

The final profit or loss figure is a critical indicator of business health:

A profit signals operational efficiency, provides funds for future growth and expansion, can be distributed to owners as dividends, and builds confidence among investors and creditors.

A loss acts as a red flag, indicating operational inefficiency or unfavourable market conditions. It leads to an erosion of the owner's capital and, if persistent, can threaten the very survival of the business. It signals to management that corrective actions are urgently needed.

3. Depiction of Financial Position

In addition to knowing the operational results, stakeholders need to understand the financial health of the business on a specific date. Accounting addresses this by aiming to ascertain and present the financial position of the business concern.

This objective is fulfilled through the preparation of a statement known as the Balance Sheet (or Position Statement). The Balance Sheet provides a snapshot of the enterprise's resources and obligations. It lists:

Assets: The economic resources owned by the business (e.g., machinery, cash, stock).

Liabilities: The claims of outsiders against those resources (e.g., loans, amounts owed to suppliers).

Capital: The claim of the owner on the business assets.

A Balance Sheet helps users judge the solvency and financial soundness of the business.

4. Providing Accounting Information to its Users

Perhaps the most critical objective of modern accounting is to communicate the generated financial information to its various interested users. The first three objectives—maintaining records, calculating profit or loss, and depicting financial position—are intermediate steps. Their value is fully realised only when the summarized information is effectively communicated to those who need it for decision-making. Accounting, in this sense, serves as a vital bridge between the economic activities of a business and the stakeholders who have an interest in those activities.

The communication process involves preparing and distributing accounting reports, such as the Profit and Loss Account, Balance Sheet, and Cash Flow Statement. These are often supplemented with graphs, charts, and detailed notes to enhance understandability. The nature and frequency of these reports are tailored to the distinct needs of two broad categories of users: internal and external.

Communicating to Internal Users

Internal users are the individuals within the organisation who are responsible for its day-to-day operations and strategic direction. They require detailed, timely, and often forward-looking information to perform their duties effectively.

Who they are: This group includes top-level management (CEO, CFO), business unit managers, plant supervisors, and other employees.

Why they need the information: Management requires information for three core functions:

Planning: Developing budgets, setting profit targets, and formulating business strategies.

Controlling: Comparing actual performance against planned targets, identifying deviations, and taking corrective actions to improve efficiency and reduce costs.

Decision-making: Making choices on a wide range of issues, such as setting the price of a product, deciding whether to make a component in-house or buy it from outside, or evaluating an investment in new machinery.

What they receive: Internal users receive customized, detailed reports that are not available to the public. These reports can be generated daily, weekly, or monthly and may include departmental profit statements, cost analysis reports, sales forecasts, and cash flow projections.

Communicating to External Users

External users are individuals and organisations outside the business who have a financial interest in the company but are not involved in its daily management. They have limited authority and resources to obtain information and must rely on the general-purpose financial statements published by the company.

Who they are: This diverse group includes present and potential investors (shareholders), lenders (banks), creditors (suppliers), tax authorities, regulatory agencies (SEBI, RBI), customers, and labour unions.

Why they need the information: Each external user group has a specific focus:

Investors: Assess the company's profitability and financial health to decide whether to buy, hold, or sell their shares.

Lenders and Creditors: Evaluate the company's solvency and liquidity to determine its ability to repay loans and pay for goods supplied on credit.

Government and Tax Authorities: Ensure compliance with laws and regulations and assess the correct amount of tax (e.g., GST, Income Tax).

Customers: Judge the long-term viability of the business to be assured of continued product supply and after-sales service.

What they receive: External users receive the company's published financial statements, typically on a quarterly and annual basis. This information is historical, highly summarized, and regulated to ensure it is reliable and comparable.

Thus, by fulfilling this communicative objective, accounting acts as the language of business, translating complex transactions into a standardized format that enables all stakeholders, both inside and outside the firm, to make informed economic decisions.

Role of Accounting

For centuries, the role of accounting was narrowly perceived as a historical record-keeping function. However, in the modern world, its role has expanded dramatically, transforming it from a simple back-office task into an indispensable pillar of business and economic activity. Accounting is no longer just a means to an end; it is an integral service function, an information system, and a language that drives commerce and governance.

1. Role as a Language of Business

Accounting is universally regarded as the language of business. Like any language, it has its own set of vocabulary (terms like assets, liabilities, equity, and revenue) and grammar (rules and principles like the double-entry system and accounting standards). It uses this structured system to communicate the financial story of an organisation.

Through financial statements, accounting conveys information about a company's:

Performance: How much profit or loss was made over a period.

Position: What the company owns and what it owes on a specific date.

Cash Flow: How cash was generated and used by the business.

By translating complex business transactions into standardized reports, it enables stakeholders—from managers to investors—to understand, analyse, and discuss the business's affairs in a common tongue.

2. Role as a Historical Record

This is the most traditional and fundamental role of accounting. It involves maintaining a chronological and systematic record of all financial transactions of an organisation. This historical data serves as a financial diary of the business.

This role is crucial because:

It creates a verifiable trail of evidence for all transactions, which is essential for audits, legal compliance, and resolving disputes.

It forms the foundational database from which all summary reports and financial statements are prepared.

It allows for trend analysis by comparing the financial data of the current period with that of past periods, helping to identify patterns of growth or decline.

3. Role as an Information System

In the modern context, accounting is best understood as a sophisticated information system. It is a process that links an information source (the accountant) to a set of receivers (the users). This system is designed to transform raw, unprocessed data into meaningful, useful information.

The process follows a clear input-process-output model:

Input: The system takes raw data about economic events, such as sales invoices, purchase bills, and bank statements.

Process: This data is then processed through the accounting cycle—it is identified, measured, recorded, classified, and summarised.

Output: The final output is refined information, presented in the form of financial statements and reports that are communicated to users for decision-making.

4. Role as a Service Activity

The primary function of accounting is to provide a service. This service consists of providing quantitative financial information to various stakeholders to help them make reasoned economic choices. By supplying reliable and relevant data, accounting helps users to allocate scarce resources (like capital and credit) efficiently.

For example, accounting information helps:

Investors decide where to invest their money for the best return.

Banks decide which businesses to grant loans to.

Management decide how to utilize the company's resources to achieve its goals.

5. Role in Depicting Current Economic Reality

While accounting heavily relies on historical cost, a more progressive role of accounting is to reflect the current economic reality of a business. Traditional accounting might show an asset at the price it was bought for decades ago, which may not be relevant today. Modern accounting standards are increasingly incorporating concepts like fair value accounting, which aims to report assets and liabilities at their current market values. This role helps in providing a more realistic picture of a company's true worth and financial position in the present day.

Basic Terms in Accounting

To understand and use the language of business, it is essential to be familiar with its fundamental vocabulary. The following are some of the most basic and frequently used terms in accounting, explained in greater detail.

1. Entity

An Entity refers to a reality that has a definite, individual existence. In accounting, a Business Entity is a specifically identifiable business enterprise, such as ITC Limited or a local grocery store. This concept is foundational to accounting because of the Business Entity Concept, which states that the business must be treated as completely separate and distinct from its owners. All accounting records are maintained from the viewpoint of the entity, not the owner. This prevents the owner's personal financial affairs from being mixed with the business's finances, allowing for a true and fair measurement of the business's performance.

2. Transaction

A Transaction is the lifeblood of accounting; it is any economic event that can be measured in monetary terms and involves an exchange of value between two or more entities. Every transaction has a dual effect that is recorded in the books. A transaction can be:

Cash Transaction: Where cash is paid or received immediately at the time of the transaction.

Credit Transaction: Where payment or receipt of cash is deferred to a future date.

Examples: When a business buys goods for ₹10,000 in cash, it's a cash transaction. If it buys the same goods with a promise to pay after 30 days, it's a credit transaction.

3. Assets

Assets are the valuable economic resources owned and controlled by an enterprise, from which future economic benefits are expected to flow to the enterprise. In simple terms, they are items of value a business uses to operate and generate revenue.

Non-Current Assets

These are assets acquired for long-term use (typically for more than one year) in the business and are not intended for resale.

Fixed Assets (Tangible): These assets have a physical existence and are used in the production or supply of goods and services. Examples: Land, Building, Machinery, Furniture, Computers. Most tangible assets, except land, are subject to depreciation.

Fixed Assets (Intangible): These are valuable non-monetary assets that lack physical substance but grant rights and advantages to the owner. Examples: Goodwill (the reputation of a business), Patents, Copyrights, Trademarks.

Current Assets

These are assets held on a short-term basis, which are expected to be converted into cash, sold, or consumed within the business's operating cycle (usually one year). They are essential for the day-to-day operations. Examples: Stock (Inventory), Debtors (Accounts Receivable), Bills Receivable, Cash, and Bank Balance.

4. Liabilities

Liabilities are the financial obligations or debts of an enterprise that it is required to pay to other entities at some point in the future. They represent the claims of outsiders (creditors) on the firm's assets and are a source of funds for the business.

Non-Current Liabilities

These are obligations that are payable after a long period, typically more than one year from the date of the Balance Sheet. They are usually incurred to finance the acquisition of non-current assets. Examples: Long-term bank loans, Debentures issued by a company.

Current Liabilities

These are obligations that are due for payment within a short period, usually one year. They typically arise from the normal course of business operations. Examples: Creditors (Accounts Payable), Bills Payable, Short-term bank borrowings, and Outstanding expenses (like salaries yet to be paid).

5. Capital

Capital is the amount invested in the business by its owner(s) to start and run it. This investment can be in the form of cash or other assets. From the business entity's perspective, capital is an "internal liability" because the business is theoretically obligated to return this amount to the owner. It represents the owner's stake or claim in the business and is also known as Owner's Equity or Net Worth. Capital increases with profits and additional investments and decreases with losses and drawings.

6. Sales

Sales are the total revenues generated from the primary operating activities of a business, which involve selling goods or providing services to customers. This is the main source of income for a trading or manufacturing company. Sales can be cash sales (immediate payment) or credit sales (payment deferred to a later date), and the total sales figure is a key indicator of business performance.

7. Revenues

Revenues (or Income) is a broader term that represents the total amount a business earns from all its activities during a period. While sales are the main revenue for most businesses, this term also encompasses other earnings. For instance, a business might earn revenue from interest on its bank deposits, commission for facilitating a deal, or rent from a property it owns. Revenue is the gross inflow of economic benefits.

8. Expenses

Expenses are the costs incurred by a business in the process of earning revenue. They represent the value of assets consumed or services used to run the business during an accounting period. To determine the true profit, expenses are matched against the revenues of the same period. Examples: Rent for the office, wages and salaries for employees, electricity bills, advertising costs, and depreciation of assets.

9. Expenditure

Expenditure is the act of spending money or incurring a liability for acquiring a benefit, service, or property. It's crucial to distinguish between its two types:

Revenue Expenditure: An expenditure where the benefit is consumed within the current accounting year. It is treated as an expense and is deducted from revenue to calculate profit. (e.g., paying salaries).

Capital Expenditure: An expenditure where the benefit lasts for more than one year. It results in the acquisition of an asset and is shown in the Balance Sheet (e.g., purchasing machinery).

10. Profit

Profit is the financial gain realized when the total revenues of a period exceed the total related expenses incurred during that same period. It is the primary objective of a for-profit business and serves as a reward for taking risks. Profit increases the owner's capital and is a key measure of a business's success and operational efficiency.

11. Gain

A Gain is a type of profit that arises from events or transactions that are incidental or peripheral to the main business activities. A gain is often irregular and non-recurring. The key difference from 'profit' is that profit comes from regular operations. Examples: A significant profit from the sale of an old office building, winning a court case, or an appreciation in the value of an investment.

12. Loss

A Loss is the excess of total expenses over total related revenues for an accounting period. It is the opposite of profit and results in a decrease in the owner's capital. The term also has a second meaning: money or money's worth lost without receiving any corresponding benefit, such as the loss of goods by theft or damage by fire.

13. Discount

A Discount is a reduction or concession in the price of goods or from the amount to be paid to a creditor. There are two main types:

Trade Discount: This is a reduction in the list price of goods, usually offered by a manufacturer to a wholesaler to encourage bulk purchases. It is not recorded in the accounting books; the transaction is simply recorded at the net price.

Cash Discount: This is a deduction offered to a debtor for making an early or prompt payment. It is an incentive to speed up cash collection and is recorded in the books as an expense for the seller and an income for the buyer.

14. Voucher

A Voucher is the primary documentary evidence that supports a business transaction. It serves as the source document and proof that a transaction has occurred. Vouchers are essential for verification and auditing purposes, as they ensure the reliability of the financial records. Examples: Cash memo for cash sales, invoice for credit purchases, a bill, a bank receipt.

15. Goods

Goods refer specifically to the products or merchandise in which a business deals. These are items purchased or manufactured with the sole intention of resale to earn a profit. The definition of 'goods' depends entirely on the nature of the business. For a furniture dealer, chairs and tables are goods. For any other business buying them for office use, they are a fixed asset (furniture).

16. Drawings

Drawings refer to any withdrawal of cash or goods by the owner from the business for personal use. As per the Business Entity Concept, the business and owner are separate. Therefore, any resource taken by the owner for non-business purposes is treated as drawings, which reduces the owner's capital investment in the business.

17. Purchases

In accounting terminology, Purchases refers exclusively to the total amount of goods procured by a business, either on cash or on credit, for the purpose of resale or for use in the manufacturing process. The purchase of an asset (like a computer for office use) is not called a purchase; it is recorded directly in the respective asset account.

18. Stock (or Inventory)

Stock is the tangible asset representing the value of goods lying unsold with the business at a particular point in time. Closing Stock is the stock at the end of an accounting period and is shown as a current asset in the Balance Sheet. This becomes the Opening Stock for the next accounting period. For a manufacturing company, stock can be in the form of raw materials, work-in-progress, or finished goods.

19. Debtors

Debtors are persons or other entities who owe an amount to the enterprise for buying goods or services on credit. They represent a future inflow of cash and are therefore classified as a current asset for the business. The total amount receivable from all debtors is often referred to as Sundry Debtors or Accounts Receivable.

20. Creditors

Creditors are persons or other entities to whom the enterprise owes money for providing goods or services on credit. They represent a future outflow of cash and are therefore classified as a current liability for the business. The total amount payable to all creditors is often referred to as Sundry Creditors or Accounts Payable.

NCERT Questions Solution

Test Your Understanding - I

Question. Complete the following sentences with appropriate words:

(a) Information in financial reports is based on .....................

(b) Internal users are the ..................... of the business entity.

(c) A ..................... would most likely use an entities financial report to determine whether or not the business entity is eligible for a loan.

(d) The Internet has assisted in decreasing the ..................... in issuing financial reports to users.

(e) ..................... users are groups outside the business entity, who uses the information to make decisions about the business entity.

(f) Information is said to be relevent if it is ......................

(g) The process of accounting starts with ............ and ends with ............

(h) Accounting measures the business transactions in terms of ............ units.

(i) Identified and measured economic events should be recording in ............ order.

Answer:

(a) Information in financial reports is based on economic events.

(b) Internal users are the management of the business entity.

(c) A lender (like a bank or financial institution) would most likely use an entities financial report to determine whether or not the business entity is eligible for a loan.

(d) The Internet has assisted in decreasing the time lag in issuing financial reports to users.

(e) External users are groups outside the business entity, who uses the information to make decisions about the business entity.

(f) Information is said to be relevant if it is capable of influencing the economic decisions of users.

(g) The process of accounting starts with identifying economic events and ends with communicating financial information.

(h) Accounting measures the business transactions in terms of monetary units.

(i) Identified and measured economic events should be recorded in chronological order.

Explanatory Notes

Here is a brief explanation for each of the answers provided above, which is crucial for a comprehensive understanding from a commerce student's perspective.

(a) Economic Events: Accounting is concerned with recording transactions that can be measured in monetary terms and affect the financial position of the business. These are known as economic events or transactions.

(b) Management: Internal users are individuals within the organisation. While this includes employees and owners, the primary internal user group that relies on financial information for planning, controlling, and decision-making is the management.

(c) Lender: Lenders (also known as creditors) such as banks need to assess the company's profitability and solvency to determine its ability to repay the loan and the associated interest. Financial reports are the primary source for this assessment.

(d) Time Lag: Traditionally, printing and mailing physical copies of financial reports took a significant amount of time. The internet allows for instantaneous dissemination of these reports through websites and email, drastically reducing the delay or time lag.

(e) External Users: This is the definition of external users. This group includes investors, creditors, government agencies (like the Income Tax Department), customers, and the general public.

(f) Relevance: This is one of the fundamental qualitative characteristics of financial information. For information to be relevant, it must have predictive value (help users make predictions about the future) and/or confirmatory value (confirm or correct past evaluations). In short, it must be able to influence decisions.

(g) Accounting Process: The entire accounting cycle begins with the identification of a business transaction. It then goes through recording, classifying, summarising, and analysing, with the final step being the communication of these results to the users through financial statements (like the Profit & Loss Account and Balance Sheet).

(h) Monetary Units: This refers to the 'Money Measurement Concept' in accounting, which states that only those transactions and events that can be expressed in terms of money are recorded in the books of accounts. In India, this unit is the Rupee ($\textsf{₹ }$).

(i) Chronological Order: Transactions are first recorded in a Journal, which is also known as a book of original entry. The process of recording in the journal is done in the order of the date of occurrence, which is known as chronological order.

Test Your Understanding - II

Question. You are a senior accountant of Ramona Enterprises Limited. What three steps would you take to make your company’s financial statements understandable and decision useful?

Answer:

As the senior accountant for Ramona Enterprises Limited, my primary responsibility is to ensure that our financial statements serve as a clear, trustworthy, and effective tool for all stakeholders—including investors, creditors, management, and regulatory bodies. To make our financial statements understandable and decision-useful, I would implement the following three fundamental steps, which are rooted in the qualitative characteristics of financial information as per the accounting framework in India.

Step 1: Ensuring Reliability of Financial Information

The foremost step is to build trust. Stakeholders must have confidence that the financial statements are free from material error and bias. Reliability is built on three pillars:

Verifiability: I would ensure that every transaction and balance reported in the financial statements is backed by concrete evidence. This involves maintaining a robust system of documentation, including invoices, contracts, bank statements, and physical verification reports. This ensures that an independent auditor or any other user could trace the numbers back to their source and arrive at the same conclusion.

Faithful Representation: My team would be directed to present a true and fair view of the company's financial position and performance. This means we must record the economic substance of transactions, not just their legal form. We would strictly adhere to the Indian Accounting Standards (Ind AS) to avoid any form of "window dressing" or manipulation that could mislead users. For instance, revenue would only be recognised when it is earned, and expenses would be matched to the period they were incurred in.

Neutrality: I would ensure that the financial statements are prepared without any bias. The information presented would not be tailored to influence a particular decision or favour one group of stakeholders over another. For example, we would make provisions for all known liabilities and doubtful debts, even if it reduces the reported profit, to provide a balanced and neutral picture.

Step 2: Enhancing the Relevance of Information

Information is useful only if it is relevant to the decision-making needs of users. It must help them evaluate past, present, or future events. The most critical component of relevance is timeliness.

Timeliness: Financial information loses its relevance if there is an undue delay in its reporting. My team and I would work diligently to close the books and prepare the financial statements well within the statutory deadlines stipulated by the Companies Act, 2013, and SEBI (if applicable). This ensures that stakeholders receive the information when it is still capable of influencing their economic decisions, such as buying or selling shares, or extending credit to the company.

Step 3: Promoting Understandability and Comparability

Even reliable and relevant information is of little use if it cannot be easily understood and compared. This final step focuses on the presentation and consistency of the financial data.

Understandability: My responsibility would be to present the financial data in a clear and concise manner, strictly adhering to the format prescribed by Schedule III of the Companies Act, 2013. I would ensure that the Notes to Accounts are written in simple language, providing clear explanations for the items in the Balance Sheet and Statement of Profit and Loss. Complex information would be broken down and explained to make it accessible to users who have a reasonable knowledge of business and economic activities.

Comparability: To allow users to identify trends and evaluate our company's performance over time and against other companies, comparability is key. To facilitate this, I would ensure that our accounting policies are applied consistently from one year to the next. If any change in accounting policy is necessary, its nature and financial impact would be fully disclosed. Furthermore, we would present all financial figures with corresponding figures for the previous year, as mandated, to allow for easy year-on-year comparison.

Test Your Understanding - III

Question. Which stakeholder group would be most interested in

(a) the VAT and other tax liabilities of the firm

(b) the potential for pay awards and bouns deals

(c) the ethical or environmental activities of the firm

(d) whether the firm has a long-term future

(e) profitability and share performance

(f) the ability of the firm to carry on providing a service or producing a product.

Answer:

Different stakeholders have varying interests in a company's financial and non-financial information, which they use to make specific economic decisions. The primary stakeholder group for each type of information is identified below:

(a) The VAT and other tax liabilities of the firm

The stakeholder group most interested in GST (previously VAT) and other tax liabilities would be the Government and other regulators. Their primary role is to ensure compliance with tax laws and to assess and collect the correct amount of tax revenue for public expenditure. This information is crucial for them to verify the firm's adherence to legal obligations.

(b) The potential for pay awards and bonus deals

The Management is the stakeholder group most interested in this. They are responsible for budgeting, financial planning, and negotiating these compensation packages. Pay awards and bonuses are significant costs that directly affect the company's profitability and cash flow, and management must assess their financial feasibility and impact on employee morale.

(c) The ethical or environmental activities of the firm

The group most focused on these activities would be Social responsibility groups. This includes Non-Governmental Organizations (NGOs), community bodies, and environmental activists. Their main purpose is to monitor corporate actions and hold firms accountable for their social and environmental impact.

(d) Whether the firm has a long-term future

Lenders, particularly those who have provided long-term loans (like debenture holders or banks), are most interested in the firm's long-term future. Their main concern is the company's ability to survive and operate profitably over the loan's duration to ensure the timely repayment of both principal and interest.

(e) Profitability and share performance

Suppliers and Creditors are highly interested in the firm's profitability. A profitable company is more likely to be able to pay its debts on time. For suppliers who provide goods or services on credit, the firm's profitability is a key indicator of its financial health and its ability to clear outstanding dues.

(f) The ability of the firm to carry on providing a service or producing a product

Customers are the stakeholders most interested in the firm's continuity. They depend on the firm for a stable supply of products and services, as well as for after-sales support and warranties. The firm's ability to continue as a going concern is directly linked to fulfilling these customer needs.

Alternate View: Summary of Stakeholder Interests

While one stakeholder group may have a primary interest, other groups are also concerned with the same information. This table summarises the primary interest as per the provided key and also notes other significant interested parties.

| Information | Primary Stakeholder | Other Interested Stakeholders |

|---|---|---|

| (a) Tax Liabilities | Government and Regulators | Investors (as it affects profit), Management (for compliance) |

| (b) Pay Awards & Bonuses | Management | Employees & Trade Unions (as recipients), Investors (as it's an expense) |

| (c) Ethical/Environmental Activities | Social Responsibility Groups | General Public, Customers, Investors (for ESG ratings) |

| (d) Long-term Future | Lenders | Investors, Employees, Management |

| (e) Profitability | Suppliers and Creditors | Investors (primary interest for returns), Management, Employees |

| (f) Ability to Continue Operations | Customers | Suppliers, Employees, Lenders |

Test Your Understanding - IV

Tick the Correct Answer

Question 1. Which of the following is not a business transaction?

(a) Bought furniture of ₹ 10,000 for business

(b) Paid for salaries of employees ₹ 5,000

(c) Paid sons fees from her personal bank account ₹ 20,000

(d) Paid sons fees from the business ₹ 2,000

Answer:

(c) Paid sons fees from her personal bank account ₹ 20,000

Reasoning:

According to the Business Entity Concept, a business and its owner are considered two separate and distinct entities. A business transaction is an economic event that affects the financial position of the business.

- Options (a), (b), and (d) all involve the use of business funds or the acquisition of assets/incurring of expenses for the business. Paying son's fees from the business (d) is recorded as 'Drawings'.

- Option (c) is a purely personal transaction. The owner is using her personal funds for a personal expense. Since it does not involve the business's resources in any way, it is not a business transaction and will not be recorded in the company's books of accounts.

Question 2. Deepti wants to buy a building for her business today. Which of the following is the relevant data for his decision?

(a) Similar business acquired the required building in 2000 for ₹ 10,00,000

(b) Building cost details of 2003

(c) Building cost details of 1998

(d) Similar building cost in August, 2005 ₹ 25,00,000

Answer:

(d) Similar building cost in August, 2005 ₹ 25,00,000

Reasoning:

For a decision to be made "today," the most relevant information is the most current and up-to-date information. Relevance is a key qualitative characteristic of accounting information, meaning the information must be capable of influencing an economic decision.

- The building costs from 1998, 2000, and 2003 are historical data. Due to inflation and changes in the real estate market, these figures are outdated and not a reliable indicator of the current cost.

- The cost of a similar building in August 2005 (assuming the decision is being made around that time) provides the most recent and therefore the most relevant benchmark for Deepti to estimate the current purchase price.

Question 3. Which is the last step of accounting as a process of information?

(a) Recording of data in the books of accounts

(b) Preparation of summaries in the form of financial statements

(c) Communication of information

(d) Analysis and interpretation of information

Answer:

(c) Communication of information

Reasoning:

The accounting process is a sequence of activities that transforms raw financial data into useful information. The final and most crucial objective of this process is to convey this information to the various stakeholders.

The logical order of the steps is:

1. Identifying and Measuring Economic Events

2. Recording of data (Journalising)

3. Classifying (Posting to Ledger)

4. Summarising (Trial Balance and Financial Statements)

5. Analysis and interpretation of information (e.g., Ratio Analysis)

6. Communication of information (Through the Annual Report, etc.)

Therefore, communication is the final step, as the entire process is futile if the results are not communicated to the users who need it for decision-making.

Question 4. Which qualitative characteristics of accounting information is reflected when accounting information is clearly presented?

(a) Understandability

(b) Relevance

(c) Comparability

(d) Reliability

Answer:

(a) Understandability

Reasoning:

The qualitative characteristics are attributes that make financial information useful to users. Understandability is the quality that information should be presented in a clear and concise manner so that it can be comprehended by users who have a reasonable knowledge of business and economic activities.

- When information is "clearly presented," it directly enhances its understandability.

- Relevance relates to the capacity of information to influence decisions.

- Comparability relates to the ability to compare information over time or with other entities.

- Reliability (or Faithful Representation) means the information is free from error and bias.

Question 5. Use of common unit of measurement and common format of reporting promotes;

(a) Comparability

(b) Understandability

(c) Relevance

(d) Reliability

Answer:

(a) Comparability

Reasoning:

Comparability is the qualitative characteristic that enables users to identify and understand similarities in, and differences among, items. To achieve comparability, financial information must be consistent.

- Using a common unit of measurement (e.g., everyone reports in $\textsf{₹ }$) and a common format of reporting (e.g., Schedule III of the Companies Act, 2013) ensures that the financial statements of different companies are prepared on a uniform basis.

- This uniformity allows users to meaningfully compare the financial performance and position of one company with another (inter-firm comparison) or of the same company over different periods (intra-firm comparison).

Test Your Understanding - V

Question 1. Mr. Sunrise started a business for buying and selling of stationery with ₹ 5,00,000 as an initial investment. Of which he paid ₹1,00,000 for furniture, ₹ 2,00,000 for buying stationery items. He employed a sales person and clerk. At the end of the month he paid ₹ 5,000 as their salaries. Out of the stationery bought he sold some stationery for ₹1,50,000 for cash and some other stationery for ₹1,00,000 on credit basis to Mr.Ravi. Subsequently, he bought stationery items of ₹1,50,000 from Mr. Peace. In the first week of next month there was a fire accident and he lost ₹ 30,000 worth of stationery. A part of the machinery, which cost ₹ 40,000, was sold for ₹ 45,000.

From the above, answer the following :

1. What is the amount of capital with which Mr. Sunrise started business.

2. What are the fixed assets he bought?

3. What is the value of the goods purchased?

4. Who is the creditor and state the amount payable to him?

5. What are the expenses?

6. What is the gain he earned?

7. What is the loss he incurred?

8. Who is the debtor? What is the amount receivable from him?

9. What is the total amount of expenses and losses incurred?

10. Determine if the following are assets, liabilities, revenues, expenses or none of the these: sales, debtors, creditors, salary to manager, discount to debtors, drawings by the owner.

Answer:

Here are the answers based on the provided business scenario of Mr. Sunrise:

1. What is the amount of capital with which Mr. Sunrise started business.

The capital is the initial amount invested by the owner to start the business. Mr. Sunrise started the business with an initial investment of $\textsf{₹ } 5,00,000$.

2. What are the fixed assets he bought?

Fixed assets are assets acquired for long-term use in the business and not for resale. He bought Furniture for $\textsf{₹ } 1,00,000$. Note: The business also had machinery, as a part of it was sold. However, the only fixed asset whose purchase is explicitly mentioned is furniture.

3. What is the value of the goods purchased?

Goods are the items the business deals in (stationery). The total value of goods purchased is the sum of all stationery purchases.

$ \text{Total Purchases} = \text{Initial Purchase} \ + \ \text{Credit Purchase from Mr. Peace} $

$ \text{Total Purchases} = \textsf{₹ } 2,00,000 \ + \ \textsf{₹ } 1,50,000 = \mathbf{\textsf{₹ } 3,50,000} $

4. Who is the creditor and state the amount payable to him?

A creditor is a person or entity to whom the business owes money. Mr. Sunrise bought stationery on credit from Mr. Peace.

The creditor is Mr. Peace, and the amount payable is $\textsf{₹ } 1,50,000$.

5. What are the expenses?

Expenses are costs incurred in the process of earning revenue. The expense mentioned is the salary paid to employees.

The expense is Salaries amounting to $\textsf{₹ } 5,000$.

6. What is the gain he earned?

A gain is a profit that arises from transactions which are incidental to the business, such as the sale of a fixed asset. The gain is calculated as the difference between the selling price and the cost of the asset.

$ \text{Gain} = \text{Selling Price of Machinery} \ - \ \text{Cost of Machinery} $

$ \text{Gain} = \textsf{₹ } 45,000 \ - \ \textsf{₹ } 40,000 = \mathbf{\textsf{₹ } 5,000} $

7. What is the loss he incurred?

A loss is an amount of money lost by a business, especially from an event not related to its normal operations. The loss incurred was due to the fire accident.

The loss is Loss by Fire, amounting to $\textsf{₹ } 30,000$.

8. Who is the debtor? What is the amount receivable from him?

A debtor is a person or entity who owes money to the business. Mr. Sunrise sold goods on credit to Mr. Ravi.

The debtor is Mr. Ravi, and the amount receivable is $\textsf{₹ } 1,00,000$.

9. What is the total amount of expenses and losses incurred?

This is the sum of all expenses and losses identified.

$ \text{Total} = \text{Salaries Expense} \ + \ \text{Loss by Fire} $

$ \text{Total} = \textsf{₹ } 5,000 \ + \ \textsf{₹ } 30,000 = \mathbf{\textsf{₹ } 35,000} $

10. Determine if the following are assets, liabilities, revenues, expenses or none of the these: sales, debtors, creditors, salary to manager, discount to debtors, drawings by the owner.

The classification is as follows:

| Item | Classification | Reason |

|---|---|---|

| Sales | Revenue | It is the income generated from the primary business activity of selling goods. |

| Debtors | Asset | It represents an amount of money that is receivable by the business in the future. |

| Creditors | Liability | It represents an amount of money that the business is obligated to pay in the future. |

| Salary to manager | Expense | It is a cost incurred for services received to run the business. |

| Discount to debtors | Expense | It is an expense (or a reduction from revenue) incurred to encourage prompt payment. |

| Drawings by the owner | Reduction from Capital (Equity) | It is the withdrawal of cash or goods by the owner for personal use. It is not an expense of the business. |

Short Answers

Question 1. Define accounting.

Answer:

According to the American Institute of Certified Public Accountants (AICPA), accounting is defined as "the art of recording, classifying, and summarising in a significant manner and in terms of money, transactions and events which are, in part at least, of a financial character, and interpreting the results thereof."

In simple terms, accounting is the systematic process of identifying, measuring, recording, and communicating the economic information of an organisation to its various users to permit informed judgments and decisions.

Question 2. State the end product of financial accounting.

Answer:

The end product of financial accounting is the preparation and presentation of Financial Statements. The primary financial statements include:

1. Statement of Profit and Loss (or Income Statement): It shows the financial performance (profit or loss) of the business for a specific accounting period.

2. Balance Sheet (or Statement of Financial Position): It presents a snapshot of the company's financial position by showing its assets, liabilities, and equity on a specific date.

3. Cash Flow Statement: It shows the movement of cash and cash equivalents into and out of the company.

4. Notes to Accounts: These provide detailed explanations and disclosures for the items presented in the financial statements.

Question 3. Enumerate main objectives of accounting.

Answer:

The main objectives of accounting are:

1. To Maintain Systematic Records: To keep a complete and systematic record of all business transactions in chronological order according to specified rules.

2. To Ascertain Profit or Loss: To determine the net result (profit earned or loss suffered) of business operations during an accounting period by preparing a Trading and Profit and Loss Account.

3. To Ascertain Financial Position: To know the financial health of the business on a particular date by preparing a Balance Sheet, which lists the assets and liabilities of the firm.

4. To Provide Information to Users: To communicate the financial information to various internal and external stakeholders like management, investors, creditors, and government for their decision-making needs.

Question 4. Who are the users of accounting information.

Answer:

The users of accounting information are broadly classified into two categories:

1. Internal Users: These are individuals within the organisation who use the information for planning, controlling, and running the business. Examples include:

- Management (at all levels)

- Owners/Partners

- Employees

2. External Users: These are individuals or organisations outside the business who have a direct or indirect interest in the business entity. Examples include:

- Investors (existing and potential)

- Lenders and Creditors (like banks)

- Government and Tax Authorities

- Customers

- Researchers and the Public

Question 5. State the nature of accounting information required by long-term lenders.

Answer:

Long-term lenders, such as banks and financial institutions providing loans for more than a year, are primarily interested in the long-term solvency and profitability of the business.

The specific information they require includes:

- Profitability Trends: Consistent profits indicate the company's ability to generate sufficient cash to repay the principal amount and interest over the life of the loan.

- Solvency Ratios: Information like the Debt-to-Equity ratio helps them assess the long-term financial risk and structure of the company.

- Cash Flow Projections: They assess the company's capacity to generate future cash flows to meet its debt obligations.

- Security of Assets: Information about the company's assets that can be offered as collateral or security for the loan.

Question 6. Who are the external users of information?

Answer:

External users are individuals, groups, or organisations outside the business entity that use the company's financial information to make decisions. They do not have direct access to the internal records of the company and rely on the published financial statements.

Key external users include:

- Investors and Shareholders: To decide whether to buy, hold, or sell their shares.

- Creditors and Lenders: To assess the creditworthiness and risk of lending money.

- Government and Tax Authorities: For tax assessment and to ensure compliance with regulations.

- Customers: To assess the long-term viability of the company, especially if they are dependent on it for products or services.

- General Public: To understand the company's role in the economy and its social responsibilities.

Question 7. Enumerate information needs of management.

Answer:

The management, as an internal user, requires detailed and frequent accounting information for its functions of planning, controlling, and decision-making. Their information needs include:

- Cost Information: To control costs and set the selling price of products.

- Performance Reports: To evaluate the performance of different departments, products, or employees.

- Budgetary Information: For comparing actual results with planned targets (budgets) and taking corrective actions.

- Sales and Profitability Data: To analyse sales trends, profitability of different products, and make strategic decisions.

- Information for Future Planning: To make investment decisions (e.g., purchasing a new machine) and forecast future performance.

Question 8. Give any three examples of revenues.

Answer:

Revenue is the income earned by a business from its normal operating activities. Three common examples are:

1. Sales: The amount received or receivable from selling goods to customers. This is the primary source of revenue for a trading or manufacturing company.

2. Commission Received: Income earned for providing services as an agent, such as a real estate agent earning a commission on a property sale.

3. Interest Received: Income earned on money lent or on investments made by the business, such as interest earned on a bank fixed deposit.

Question 9. Distinguish between debtors and creditors; profit and gain

Answer:

Distinction between Debtors and Creditors

| Basis | Debtors | Creditors |

|---|---|---|

| Meaning | A person or entity who owes money to the business. | A person or entity to whom the business owes money. |

| Arises from | Arises from credit sales of goods or services. | Arises from credit purchases of goods, services, or assets. |

| Nature of Account | It is an Asset for the business (specifically, a Current Asset). | It is a Liability for the business (specifically, a Current Liability). |

| Also known as | Accounts Receivable or Sundry Debtors. | Accounts Payable or Sundry Creditors. |

Distinction between Profit and Gain

| Basis | Profit | Gain |

|---|---|---|

| Meaning | The excess of revenues over related expenses during an accounting period. | A monetary benefit that arises from transactions which are incidental to the business. |

| Nature of Activity | Arises from the regular, primary operating activities of the business. | Arises from non-recurring or non-operating activities. |

| Example | Profit from selling stationery by a stationery shop. | Gain from the sale of an old fixed asset (like machinery) for more than its book value. |

Question 10. ‘Accounting information should be comparable’. Do you agree with this statement. Give two reasons.

Answer:

Yes, I completely agree with the statement that 'Accounting information should be comparable'. Comparability is a crucial qualitative characteristic that significantly enhances the usefulness of financial statements.

Here are two reasons:

1. Intra-firm Comparison: Comparability allows a business to compare its own financial results from one accounting period to another. This helps in identifying trends in performance and financial position. For example, management can analyse if sales are growing or if costs are increasing over the years, which is vital for planning and control.

2. Inter-firm Comparison: It enables users, especially investors, to compare the financial statements of one enterprise with those of another in the same industry. This helps in evaluating the relative performance, financial strength, and investment potential of different companies. For this to be effective, companies must use consistent accounting policies and formats.

Question 11. If the accounting information is not clearly presented, which of the qualitative characteristic of the accounting information is violated?

Answer:

If the accounting information is not clearly presented, the qualitative characteristic of Understandability is violated.

Understandability implies that the information provided in the financial statements must be presented in a manner that is readily comprehensible to users who have a reasonable knowledge of business and economic activities. Presenting information clearly and concisely, with proper classification and aggregation, is essential to meet this characteristic.

Question 12. “The role of accounting has changed over the period of time”- Do you agree? Explain.

Answer:

Yes, I agree that the role of accounting has changed significantly over time.

Historically, the primary role of accounting was limited to stewardship. It was mainly a record-keeping function, focused on tracking the funds entrusted to management by the owners and reporting on their utilisation. The focus was on preparing historical financial statements for accountability.

However, in the modern business environment, the role has evolved dramatically. Today, accounting is seen as a comprehensive information and decision-support system. Its role now includes:

- Decision Making: Providing relevant and timely information to management for making strategic decisions about pricing, investment, and operations.

- Control: Helping in controlling costs and evaluating performance through techniques like budgetary control and standard costing.

- Forecasting: Using historical data to forecast future revenues, profits, and cash flows.

- Compliance and Governance: Ensuring compliance with complex legal requirements (like Ind AS and the Companies Act) and promoting good corporate governance.

Thus, accounting has transformed from a mere historical record-keeper to a vital, forward-looking function essential for the survival and growth of a business.

Question 13. Giving examples, explain each of the following accounting terms :

- Fixed assets

- Revenue

- Expenses

- Short-term liability

- Capital

Answer:

| Term | Explanation | Example(s) |

|---|---|---|