| Accountancy NCERT Notes, Solutions and Extra Q & A (Class 11th & 12th) | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 11th | 12th | ||||||||||||||||||

Chapter 3 Recording Of Transactions-I Concepts, Solutions and Extra Q & A

This chapter outlines the fundamental mechanics of recording business transactions. The process begins with identifying a transaction, which must be evidenced by a Source Document like an invoice or receipt. This document is the basis for creating an accounting voucher, which specifies the accounts to be debited and credited. Every transaction maintains the balance of the core Accounting Equation: Assets = Liabilities + Capital, reflecting the dual aspect of accounting.

Transactions are recorded using the rules of Debit and Credit, which vary depending on the five account types: Assets, Liabilities, Capital, Expenses, and Revenues. Initially, transactions are recorded chronologically in the Journal, the book of original entry, in a process called journalising. Subsequently, these entries are transferred, or 'posted', to the Ledger, which is the principal book that classifies and summarises all transactions by individual account, providing a consolidated view needed for financial analysis.

Business Transactions And Source Documents

The accounting process is a systematic procedure that begins with the identification of business transactions. A business transaction is an economic event that involves a measurable exchange of value between two or more parties, which affects the financial position (assets, liabilities, or capital) of the business. Every transaction has a dual effect, often described as a 'give and take' aspect. For example, when a business purchases a computer for ₹35,000 cash, it 'gives' cash and 'takes' a computer. This duality is the foundation of the double-entry system.

For a transaction to be recorded, it must be supported by verifiable evidence. This evidence comes in the form of Source Documents. A source document is the original record containing the details of a transaction and serves as the primary proof of its occurrence.

Key Source Documents

Cash Memo: A document prepared for cash sales, detailing the items sold, quantity, rate, and total amount received.

Invoice or Bill: A document prepared for credit sales, containing similar details as a cash memo but also specifying the terms of credit.

Receipt: An acknowledgement of cash or cheque received from a party.

Pay-in-Slip: A form used to deposit cash or cheques into a bank account. The counterfoil of the slip, stamped by the bank, acts as the source document.

Cheque: The counterfoil or record slip of a cheque book serves as the evidence for payments made through the bank.

These documents are crucial as they provide an objective and verifiable basis for recording transactions, and are essential for auditing and tax assessment purposes. All source documents are typically arranged chronologically, serially numbered, and filed for future reference.

Preparation Of Accounting Vouchers

While a source document is the evidence of a transaction, an Accounting Voucher is a formal document prepared internally based on the source document. It serves as a written authorization and instruction to record the transaction in the books of accounts, clearly indicating which accounts are to be debited and which are to be credited.

Vouchers are the primary basis for making entries in the journal. They must be preserved carefully until the audit for the relevant period is complete. In modern computerized accounting, vouchers are often generated electronically, complete with account codes.

Types of Accounting Vouchers

Vouchers are classified based on the complexity of the transaction they represent:

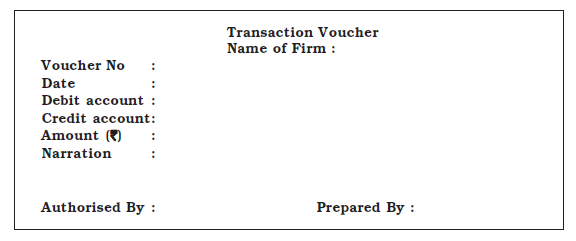

Transaction Voucher (Simple Voucher): This voucher is prepared for a simple transaction that affects only two accounts—one debit and one credit.

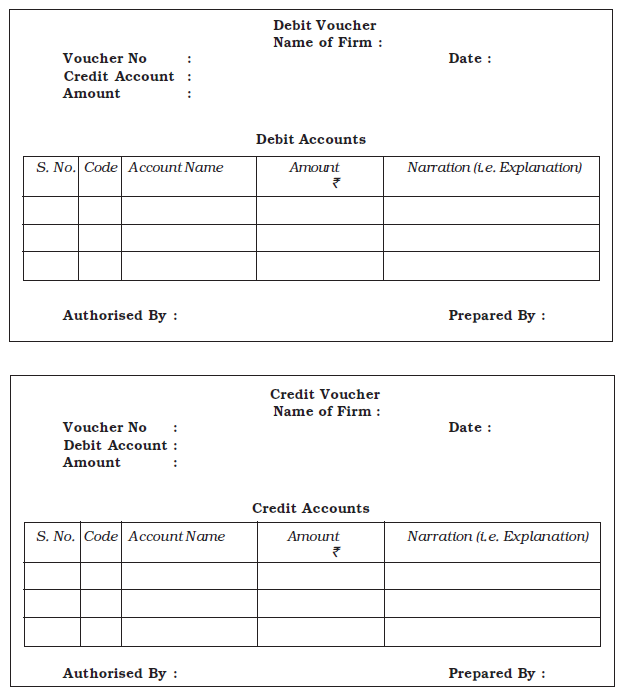

Compound Voucher: This voucher is prepared for a transaction that affects more than two accounts. It can be of two types:

Debit Voucher: Used for a transaction with multiple debits and a single credit. For example, paying for both salaries (Dr.) and rent (Dr.) using a single cheque (Cr. Bank).

Credit Voucher: Used for a transaction with a single debit and multiple credits. For example, selling goods where part of the payment is received in cash (Dr. Cash) and part is on credit (Dr. Debtor), against a single sale (Cr. Sales).

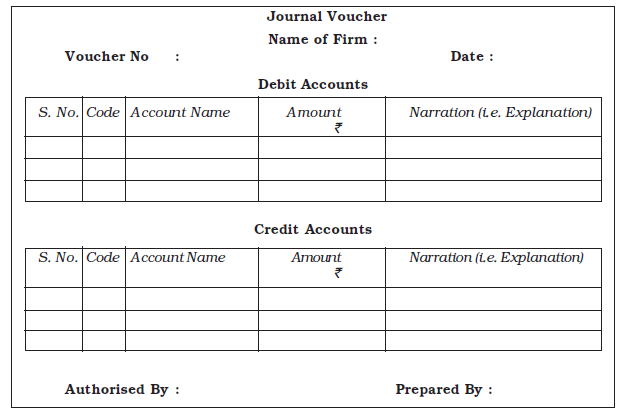

Complex Voucher (or Journal Voucher): This is prepared for complex transactions that involve multiple debit accounts and multiple credit accounts. For example, purchasing an asset where part payment is made in cash, part by cheque, and the rest remains as a liability.

Essential Elements of an Accounting Voucher

A well-prepared accounting voucher must contain the following essential elements to be complete and valid:

It should be written on good quality paper with the firm's name printed on top.

The date of the transaction must be clearly mentioned (not the date of recording).

Vouchers should be serially numbered for control and easy reference.

The names of the accounts to be debited and credited must be specified.

The amount of the debit and credit must be written clearly in figures.

A brief description of the transaction, known as a narration, should be provided.

It must be signed by the person who prepared it and by an authorized person to validate it.

Accounting Equation

The Accounting Equation is a fundamental concept that provides the very foundation of the double-entry accounting system. It signifies that at any point in time, the total assets of a business are always equal to the total of its liabilities and capital (also known as owner's equity). This relationship represents the core logic of a company's financial structure.

The equation reads as follows:

$ Assets = Liabilities + Capital $

This equation holds true because all the resources a business owns (Assets) must be financed by or claimed by either outsiders (Liabilities) or the owners themselves (Capital). There can be no other source.

Derivatives of the Equation

The equation can also be rearranged to determine any of its missing components:

To find Capital: $ Capital = Assets - Liabilities $

To find Liabilities: $ Liabilities = Assets - Capital $

The Balance Sheet Equation

Since the accounting equation depicts the fundamental relationship among the components of a balance sheet, it is also known as the Balance Sheet Equation. The Balance Sheet is a financial statement that presents the assets, liabilities, and capital of a business on a specific date. The equality of the assets side and the liabilities & capital side of the balance sheet is an undeniable fact, which justifies this alternative name.

Effect of Transactions on the Accounting Equation

Every business transaction causes changes in the values of assets, liabilities, or capital, but it always affects the equation in such a manner that the equality is maintained. Let's analyze the effect of a series of transactions for a new business.

Example 1. Rohit started a business with ₹5,00,000 cash. Analyse the effect of this and the following transactions on the accounting equation.

Opened a bank account by depositing ₹4,80,000.

Bought furniture for ₹60,000 and paid by cheque.

Bought plant and machinery for ₹1,25,000 from M/s Ramjee Lal, paying ₹10,000 as a cash advance.

Purchased goods on credit from M/s Sumit Traders for ₹55,000.

Sold goods costing ₹25,000 for ₹35,000 on credit to Rajani Enterprises.

Answer:

We start with the initial state after Rohit commenced the business:

Initial Equation: Assets (Cash ₹5,00,000) = Liabilities (₹0) + Capital (₹5,00,000)

1. Opened a bank account by depositing ₹4,80,000.

Analysis: This transaction involves the movement of funds from one asset form (Cash) to another (Bank). It does not involve any external party or affect the owner's claim.

Effect on Assets: The 'Cash' asset decreases by ₹4,80,000, and the 'Bank' asset increases by ₹4,80,000. The total value of assets remains unchanged.

Effect on Liabilities and Capital: There is no change in Liabilities or Capital.

Resulting Equation:

Assets (Cash ₹20,000 + Bank ₹4,80,000) = Liabilities (₹0) + Capital (₹5,00,000)

₹5,00,000 = ₹0 + ₹5,00,000

2. Bought furniture for ₹60,000 and paid by cheque.

Analysis: The business acquires a new asset (Furniture) by giving up another asset (Bank balance).

Effect on Assets: The 'Furniture' asset increases by ₹60,000, and the 'Bank' asset decreases by ₹60,000. The total value of assets remains unchanged.

Effect on Liabilities and Capital: There is no change in Liabilities or Capital.

Resulting Equation:

Assets (Cash ₹20,000 + Bank ₹4,20,000 + Furniture ₹60,000) = Liabilities (₹0) + Capital (₹5,00,000)

₹5,00,000 = ₹0 + ₹5,00,000

3. Bought plant and machinery for ₹1,25,000 from M/s Ramjee Lal, paying ₹10,000 as a cash advance.

Analysis: The business acquires an asset (Plant & Machinery) by giving up some cash and creating a liability for the remaining amount owed.

Effect on Assets: The 'Plant & Machinery' asset increases by ₹1,25,000, while the 'Cash' asset decreases by ₹10,000. The net increase in total assets is ₹1,15,000.

Effect on Liabilities and Capital: The liability to M/s Ramjee Lal (Creditors) increases by the unpaid amount of ₹1,15,000 (₹1,25,000 - ₹10,000). There is no change in Capital.

Resulting Equation: Both the Assets side and the Liabilities side of the equation increase by ₹1,15,000, maintaining the balance.

Assets (Cash ₹10,000 + Bank ₹4,20,000 + Furniture ₹60,000 + P&M ₹1,25,000) = Liabilities (Creditors ₹1,15,000) + Capital (₹5,00,000)

₹6,15,000 = ₹1,15,000 + ₹5,00,000

4. Purchased goods on credit from M/s Sumit Traders for ₹55,000.

Analysis: The business acquires an asset (Stock of Goods) by creating a liability to pay the supplier later.

Effect on Assets: The 'Stock' asset increases by ₹55,000.

Effect on Liabilities and Capital: The liability to M/s Sumit Traders (Creditors) increases by ₹55,000. There is no change in Capital.

Resulting Equation: Both the Assets side and the Liabilities side increase by ₹55,000, maintaining the balance.

Assets (Cash ₹10,000 + Bank ₹4,20,000 + Furniture ₹60,000 + P&M ₹1,25,000 + Stock ₹55,000) = Liabilities (Creditors ₹1,70,000) + Capital (₹5,00,000)

₹6,70,000 = ₹1,70,000 + ₹5,00,000

5. Sold goods costing ₹25,000 for ₹35,000 on credit to Rajani Enterprises.

Analysis: This transaction has a dual effect on assets and also affects capital. The business gives up one asset (Stock) and receives another (Debtors). The difference between the selling price and the cost is profit, which increases the owner's capital.

Effect on Assets: The 'Stock' asset decreases by its cost of ₹25,000. A new asset, 'Debtors' (amount receivable from Rajani Enterprises), increases by the selling price of ₹35,000. The net effect is an increase in total assets by ₹10,000 (₹35,000 - ₹25,000).

Effect on Liabilities and Capital: There is no change in Liabilities. The profit of ₹10,000 (₹35,000 - ₹25,000) increases the Capital.

Resulting Equation: Both the Assets side and the Capital side increase by ₹10,000, maintaining the balance.

Assets (Cash ₹10,000 + Bank ₹4,20,000 + Debtors ₹35,000 + Stock ₹30,000 + Furniture ₹60,000 + P&M ₹1,25,000) = Liabilities (Creditors ₹1,70,000) + Capital (₹5,10,000)

₹6,80,000 = ₹1,70,000 + ₹5,10,000

Analysis Table Showing Effect on Accounting Equation

| Transaction | Assets (₹) | = | Liabilities (₹) | + | Capital (₹) | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| Cash | Bank | Debtors | Stock (Goods) | Furniture | Plant & Machinery | = | Creditors | + | (Owner's Equity) | |

| Started business | +5,00,000 | = | + | +5,00,000 | ||||||

| New Equation | 5,00,000 | 0 | 0 | 0 | 0 | 0 | = | 0 | + | 5,00,000 |

| 1. Deposit in Bank | -4,80,000 | +4,80,000 | = | + | ||||||

| New Equation | 20,000 | 4,80,000 | 0 | 0 | 0 | 0 | = | 0 | + | 5,00,000 |

| 2. Buy Furniture | -60,000 | +60,000 | = | + | ||||||

| New Equation | 20,000 | 4,20,000 | 0 | 0 | 60,000 | 0 | = | 0 | + | 5,00,000 |

| 3. Buy P&M | -10,000 | +1,25,000 | = | +1,15,000 | + | |||||

| New Equation | 10,000 | 4,20,000 | 0 | 0 | 60,000 | 1,25,000 | = | 1,15,000 | + | 5,00,000 |

| 4. Buy Goods (Credit) | +55,000 | = | +55,000 | + | ||||||

| New Equation | 10,000 | 4,20,000 | 0 | 55,000 | 60,000 | 1,25,000 | = | 1,70,000 | + | 5,00,000 |

| 5. Sell Goods (Credit) | +35,000 | -25,000 | = | + | +10,000 (Profit) | |||||

| Final Equation | 10,000 | 4,20,000 | 35,000 | 30,000 | 60,000 | 1,25,000 | = | 1,70,000 | + | 5,10,000 |

Final Position Summarised as a Balance Sheet

The final equation shows the financial position of the business, which can be presented in the form of a Balance Sheet:

Balance Sheet of Rohit as at ...

| Liabilities | Amount ($\textsf{₹ }$) | Assets | Amount ($\textsf{₹ }$) |

|---|---|---|---|

| Creditors | 1,70,000 | Cash | 10,000 |

| Capital | 5,10,000 | Bank | 4,20,000 |

| Debtors | 35,000 | ||

| Stock | 30,000 | ||

| Furniture | 60,000 | ||

| Plant & Machinery | 1,25,000 | ||

| Total | 6,80,000 | Total | 6,80,000 |

Using Debit and Credit

As we have established, every business transaction has a dual effect, a 'give' and a 'take' aspect. To record this duality systematically, the double-entry system of accounting uses two fundamental terms: Debit (Dr.) and Credit (Cr.). These terms are simply the technical language of accounting used to indicate the left and right sides of an account, respectively.

For a clear visual understanding, an account is often represented in a 'T' shape, which is why it is commonly referred to as a T-account. This format helps in visualizing how transactions affect an account.

| Account Title | |

|---|---|

| Debit (Dr.) Side | Credit (Cr.) Side |

To debit an account means to make an entry on the left side of the account.

To credit an account means to make an entry on the right side of the account.

The core principle of the double-entry system is that for every transaction, the total amount debited must be equal to the total amount credited, keeping the accounting equation in balance.

Rules of Debit and Credit

To apply the debit and credit system correctly, all accounts are classified into five main categories. The rules for debiting and crediting an account depend on its category and whether the transaction is causing an increase or a decrease in that account's balance.

The Five Categories of Accounts

Assets: Resources owned by the business (e.g., Cash, Building, Machinery, Debtors).

Liabilities: Obligations owed to outsiders (e.g., Creditors, Bank Loans).

Capital: The owner's investment in the business (Owner's Equity).

Expenses/Losses: Costs incurred to earn revenue (e.g., Salaries, Rent, Purchases).

Revenues/Gains: Income earned from business operations (e.g., Sales, Commission Received).

The Fundamental Rules and their Logic

The rules of debit and credit are logically derived from the Accounting Equation ($Assets = Liabilities + Capital$).

Rule 1: For Assets and Expenses/Losses

An INCREASE in an Asset or Expense is a DEBIT.

A DECREASE in an Asset or Expense is a CREDIT.

Logic: Assets are on the left side of the accounting equation. Therefore, an increase in an asset is recorded on the left (debit) side of the account. Expenses ultimately decrease Capital (which is on the right side of the equation). A decrease in Capital is a debit, so an increase in an expense is also a debit.

Rule 2: For Liabilities, Capital, and Revenues/Gains

An INCREASE in a Liability, Capital, or Revenue is a CREDIT.

A DECREASE in a Liability, Capital, or Revenue is a DEBIT.

Logic: Liabilities and Capital are on the right side of the accounting equation. Therefore, an increase in a liability or capital is recorded on the right (credit) side of the account. Revenues ultimately increase Capital, so an increase in revenue is also a credit.

Summary of Rules

| Account Category | Debit (Dr.) Entry Signifies | Credit (Cr.) Entry Signifies |

|---|---|---|

| Assets | Increase (+) | Decrease (-) |

| Expenses/Losses | Increase (+) | Decrease (-) |

| Liabilities | Decrease (-) | Increase (+) |

| Capital | Decrease (-) | Increase (+) |

| Revenues/Gains | Decrease (-) | Increase (+) |

Rules Represented in T-Account Format

The rules of debit and credit for each account category can also be visualized using the T-account format. This clearly shows which side of the account is used for recording increases and which side is for decreases.

1. Asset Accounts

| Asset Account | |

|---|---|

|

Debit (Dr.) Increase (+) |

Credit (Cr.) Decrease (-) |

2. Expense/Loss Accounts

| Expense/Loss Account | |

|---|---|

|

Debit (Dr.) Increase (+) |

Credit (Cr.) Decrease (-) |

3. Liability Accounts

| Liability Account | |

|---|---|

|

Debit (Dr.) Decrease (-) |

Credit (Cr.) Increase (+) |

4. Capital Accounts

| Capital Account | |

|---|---|

|

Debit (Dr.) Decrease (-) |

Credit (Cr.) Increase (+) |

5. Revenue/Gain Accounts

| Revenue/Gain Account | |

|---|---|

|

Debit (Dr.) Decrease (-) |

Credit (Cr.) Increase (+) |

Applying the Rules: Transaction Analysis with T-Accounts

Let's apply the rules of debit and credit to analyse the transactions from the example, showing the effect on each account using T-shaped tables.

-

Rohit started business with cash ₹5,00,000.

- Analysis: Cash (Asset) increases, so it is debited. Capital (Capital) increases, so it is credited.

T-Account Effect:

Cash A/c (1) 5,00,000 Capital A/c (1) 5,00,000 -

Opened a bank account with ₹4,80,000.

- Analysis: Bank (Asset) increases, so it is debited. Cash (Asset) decreases, so it is credited.

T-Account Effect:

Bank A/c (2) 4,80,000 Cash A/c (2) 4,80,000 -

Bought furniture for ₹60,000, paid by cheque.

- Analysis: Furniture (Asset) increases, so it is debited. Bank (Asset) decreases, so it is credited.

T-Account Effect:

Furniture A/c (3) 60,000 Bank A/c (3) 60,000 -

Bought Plant & Machinery from Ramjee Lal for ₹1,25,000; paid ₹10,000 cash, balance due.

- Analysis: Plant & Machinery (Asset) increases (Debit). Cash (Asset) decreases (Credit). Ramjee Lal (Liability) increases (Credit).

T-Account Effect:

Plant & Machinery A/c (4) 1,25,000 Cash A/c (4) 10,000 Ramjee Lal's A/c (4) 1,15,000 -

Purchased goods from Sumit Traders for ₹55,000 on credit.

- Analysis: Purchases (Expense) increases, so it is debited. Sumit Traders (Liability) increases, so it is credited.

T-Account Effect:

Purchases A/c (5) 55,000 Sumit Traders A/c (5) 55,000 -

Sold goods to Rajani Enterprises for ₹35,000 on credit.

- Analysis: Rajani Enterprises (Asset - Debtor) increases, so it is debited. Sales (Revenue) increases, so it is credited.

T-Account Effect:

Rajani Enterprises A/c (6) 35,000 Sales A/c (6) 35,000 -

Paid monthly store rent ₹2,500 in cash.

- Analysis: Rent (Expense) increases, so it is debited. Cash (Asset) decreases, so it is credited.

T-Account Effect:

Rent A/c (7) 2,500 Cash A/c (7) 2,500 -

Paid ₹5,000 as salary to employees.

- Analysis: Salary (Expense) increases, so it is debited. Cash (Asset) decreases, so it is credited.

T-Account Effect:

Salary A/c (8) 5,000 Cash A/c (8) 5,000 -

Received cheque from Rajani Enterprises (₹35,000) and deposited same day.

- Analysis: Bank (Asset) increases, so it is debited. Rajani Enterprises (Asset - Debtor) decreases, so it is credited.

T-Account Effect:

Bank A/c (9) 35,000 Rajani Enterprises A/c (9) 35,000

Books of Original Entry

While analyzing transactions and their effect on accounts is a useful learning exercise, in a real accounting system, transactions are not recorded directly into ledger accounts. The first book where a transaction is formally recorded is called a Book of Original Entry or Primary Book of Entry. This recording is done based on source documents.

The primary purpose of original entry books is to provide a complete chronological record of all transactions in one place, showing the debit and credit aspects for each event. The initial recording process is known as Journalising when done in the Journal.

After transactions are recorded in the book of original entry, the debit and credit amounts are transferred to the individual ledger accounts. This transfer process is called Posting.

Due to the large volume and variety of transactions, the book of original entry is often subdivided into several specialized books (also called Day Books or Subsidiary Books) in addition to the main Journal:

Journal Proper: Used for transactions that do not fit into any of the special day books.

Cash Book: Used to record all cash receipts and payments.

Other Day Books:

Purchases Book (for credit purchases of goods)

Sales Book (for credit sales of goods)

Purchase Returns Book (for goods returned to suppliers)

Sales Returns Book (for goods returned by customers)

Bills Receivable Book (for bills received)

Bills Payable Book (for bills accepted/issued)

This chapter primarily focuses on the Journal Proper and its posting to the Ledger. The specialized day books like the Cash Book are covered in detail in later chapters.

Journal

The Journal is the most basic book of original entry. Transactions are recorded here in the order they occur (chronological order). Each transaction is analyzed, and the accounts to be debited and credited are identified and recorded along with the respective amounts.

Format of a Journal

The format of a Journal is standard, containing five distinct columns:

| Date | Particulars | L.F. | Debit Amount (₹) | Credit Amount (₹) |

|---|---|---|---|---|

Explanation of Journal Columns:

Date: This column records the year, month, and day on which the transaction occurred.

Particulars: This is the main column where the transaction is described.

The name of the account to be debited is written first, starting from the left margin, followed by 'Dr.'.

The name of the account to be credited is written on the next line, indented slightly, with the prefix 'To'.

A brief description of the transaction, called the Narration, is written below the accounts, usually in parentheses.

A line is drawn in this column after each entry to separate transactions.

L.F. (Ledger Folio): This column is left blank during journalizing. It is filled in later with the page number of the ledger account at the time the entry is posted.

Debit Amount: The amount to be debited is entered in this column, on the same line as the debit account.

Credit Amount: The amount to be credited is entered in this column, on the same line as the credit account.

At the end of each page, the Debit and Credit amount columns are totaled and carried forward ('c/f') to the next page, where they are shown as 'brought forward' ('b/f').

Types of Journal Entries:

Simple Journal Entry: Involves only two accounts (one account is debited, and one account is credited).

Compound Journal Entry: Involves more than two accounts (e.g., multiple debits and one credit, or one debit and multiple credits).

Example 1. (Simple Entry) Goods purchased on credit from M/s Govind Traders for ₹30,000.

Answer:

| Date | Particulars | L.F. | Debit Amount (₹) | Credit Amount (₹) |

|---|---|---|---|---|

| 2017 | ||||

| Dec. 24 | Purchases A/cDr. | 30,000 | ||

| To Govind Traders A/c | 30,000 | |||

| (Being purchase of goods-in-trade from Govind Traders) |

Example 2. (Compound Entry) Office furniture purchased for ₹25,000; ₹5,000 paid in cash, balance ₹20,000 due to Modern Furnitures.

Answer:

| Date | Particulars | L.F. | Debit Amount (₹) | Credit Amount (₹) |

|---|---|---|---|---|

| 2017 | ||||

| July 04 | Office Furniture A/cDr. | 25,000 | ||

| To Cash A/c | 5,000 | |||

| To Modern Furnitures A/c | 20,000 | |||

| (Being office furniture purchased, part paid in cash and balance on credit) |

A journal entry is the first step in the accounting cycle, where business transactions are recorded chronologically. Each entry shows the accounts affected and follows the fundamental rule of double-entry accounting: for every transaction, the total debits must equal the total credits. Below are examples of various transactions, their analysis, and their corresponding journal entries.

Transaction 1: Commencing Business with Cash

Transaction: On April 1, 2023, Mr. Sharma started a business by investing ₹5,00,000 in cash.

Analysis of the Transaction

-

Accounts Involved: Cash Account and Capital Account.

-

Nature of Accounts: Cash is an Asset, and Capital is Owner's Equity/Capital.

-

Rules Applied: The business receives cash, so the 'Cash' (Asset) account increases. An increase in an asset is debited. The investment by the owner increases the 'Capital' of the business. An increase in capital is credited.

Journal Entry

| Date | Particulars | L.F. | Debit Amount (₹) | Credit Amount (₹) |

|---|---|---|---|---|

| 2023 | ||||

| Apr. 01 | Cash A/cDr. | 5,00,000 | ||

| To Capital A/c | 5,00,000 | |||

| (Being business started with cash) |

Transaction 2: Purchase of Goods on Credit

Transaction: On April 5, 2023, purchased goods worth ₹40,000 from 'Modern Traders' on credit.

Analysis of the Transaction

-

Accounts Involved: Purchases Account and Modern Traders Account.

-

Nature of Accounts: Purchases is an Expense, and Modern Traders is a Creditor, which is a Liability.

-

Rules Applied: Purchasing goods is an expense for the business, so the 'Purchases' (Expense) account increases. An increase in an expense is debited. The amount is owed to Modern Traders, increasing the business's liability. An increase in a liability is credited.

Journal Entry

| Date | Particulars | L.F. | Debit Amount (₹) | Credit Amount (₹) |

|---|---|---|---|---|

| 2023 | ||||

| Apr. 05 | Purchases A/cDr. | 40,000 | ||

| To Modern Traders A/c | 40,000 | |||

| (Being goods purchased on credit from Modern Traders) |

Transaction 3: Sale of Goods for Cash

Transaction: On April 10, 2023, sold goods for ₹25,000 cash.

Analysis of the Transaction

-

Accounts Involved: Cash Account and Sales Account.

-

Nature of Accounts: Cash is an Asset, and Sales is a Revenue.

-

Rules Applied: The business receives cash, so the 'Cash' (Asset) account increases. An increase in an asset is debited. Selling goods generates revenue for the business, so the 'Sales' (Revenue) account increases. An increase in revenue is credited.

Journal Entry

| Date | Particulars | L.F. | Debit Amount (₹) | Credit Amount (₹) |

|---|---|---|---|---|

| 2023 | ||||

| Apr. 10 | Cash A/cDr. | 25,000 | ||

| To Sales A/c | 25,000 | |||

| (Being goods sold for cash) |

Transaction 4: Payment of an Expense

Transaction: On April 30, 2023, paid office rent of ₹15,000 by cheque.

Analysis of the Transaction

-

Accounts Involved: Rent Account and Bank Account.

-

Nature of Accounts: Rent is an Expense, and Bank is an Asset.

-

Rules Applied: Paying rent is an expense for the business, so the 'Rent' (Expense) account increases. An increase in an expense is debited. The payment is made by cheque, which reduces the bank balance. A decrease in an 'Bank' (Asset) is credited.

Journal Entry

| Date | Particulars | L.F. | Debit Amount (₹) | Credit Amount (₹) |

|---|---|---|---|---|

| 2023 | ||||

| Apr. 30 | Rent A/cDr. | 15,000 | ||

| To Bank A/c | 15,000 | |||

| (Being office rent paid by cheque) |

Transaction 5: Compound Journal Entry

Transaction: On May 15, 2023, purchased machinery for ₹1,00,000. Paid ₹20,000 in cash immediately and the balance is due to 'Heavy Machines Ltd.'

Analysis of the Transaction

-

Accounts Involved: Machinery Account, Cash Account, and Heavy Machines Ltd. Account.

-

Nature of Accounts: Machinery is an Asset, Cash is an Asset, and Heavy Machines Ltd. is a Creditor (Liability).

-

Rules Applied: The business acquires machinery, so the 'Machinery' (Asset) account increases by ₹1,00,000. An increase in an asset is debited. The business pays cash, so the 'Cash' (Asset) account decreases by ₹20,000. A decrease in an asset is credited. An obligation to pay Heavy Machines Ltd. is created, so the 'Heavy Machines Ltd.' (Liability) account increases by ₹80,000. An increase in a liability is credited.

Journal Entry

| Date | Particulars | L.F. | Debit Amount (₹) | Credit Amount (₹) |

|---|---|---|---|---|

| 2023 | ||||

| May 15 | Machinery A/cDr. | 1,00,000 | ||

| To Cash A/c | 20,000 | |||

| To Heavy Machines Ltd. A/c | 80,000 | |||

| (Being machinery purchased, part payment made in cash) |

Journal Entries for Rohit's Business

Example. Rohit started a business with ₹5,00,000 cash. Analyse the effect of this and the following transactions on the accounting equation.

Opened a bank account by depositing ₹4,80,000.

Bought furniture for ₹60,000 and paid by cheque.

Bought plant and machinery for ₹1,25,000 from M/s Ramjee Lal, paying ₹10,000 as a cash advance.

Purchased goods on credit from M/s Sumit Traders for ₹55,000.

Sold goods costing ₹25,000 for ₹35,000 on credit to Rajani Enterprises.

Answer:

Journal Entries

| Date | Particulars | L.F. | Debit Amount (₹) | Credit Amount (₹) |

|---|---|---|---|---|

| [Year] | ||||

| [Date 1] | Cash A/cDr. | 5,00,000 | ||

| To Capital A/c | 5,00,000 | |||

| (Business started with cash) | ||||

| [Date 2] | Bank A/cDr. | 4,80,000 | ||

| To Cash A/c | 4,80,000 | |||

| (Opened bank account) | ||||

| [Date 3] | Furniture A/cDr. | 60,000 | ||

| To Bank A/c | 60,000 | |||

| (Purchased furniture and made payment through bank) | ||||

| [Date 4] | Plant and Machinery A/cDr. | 1,25,000 | ||

| To Cash A/c | 10,000 | |||

| To Ramjee Lal A/c | 1,15,000 | |||

| (Bought Plant and Machinery from M/s Ramjee Lal, made an advance payment by cash) | ||||

| [Date 5] | Purchases A/cDr. | 55,000 | ||

| To M/s Sumit Traders A/c | 55,000 | |||

| (Goods bought on credit) | ||||

| [Date 6] | Rajani Enterprises A/cDr. | 35,000 | ||

| To Sales A/c | 35,000 | |||

| (Goods sold on profit) | ||||

| Total | 12,55,000 | 12,55,000 |

Illustrations of Journal Entries

Illustration. Journalise the following transactions of Soraj Mart for April, 2017.

- Apr. 01: Business started with cash ₹1,50,000.

- Apr. 01: Goods purchased from Manisha on credit ₹36,000.

- Apr. 02: Opened a bank account with SBI for ₹35,000.

- Apr. 14: Insurance premium paid by cheque ₹6,000.

- Apr. 20: Goods costing ₹1,500 given as charity.

- Apr. 29: Cash withdrawn for household purposes ₹5,000.

Answer:

Books of Saroj Mart

Journal

| Date | Particulars | L.F. | Debit Amount (₹) | Credit Amount (₹) |

|---|---|---|---|---|

| 2017 | ||||

| Apr. 01 | Cash A/cDr. | 1,50,000 | ||

| To Capital A/c | 1,50,000 | |||

| (Being business started with cash) | ||||

| Apr. 01 | Purchases A/cDr. | 36,000 | ||

| To Manisha's A/c | 36,000 | |||

| (Being goods purchased on credit from Manisha) | ||||

| Apr. 02 | Bank A/cDr. | 35,000 | ||

| To Cash A/c | 35,000 | |||

| (Being cash deposited into bank to open an account) | ||||

| Apr. 14 | Insurance Premium A/cDr. | 6,000 | ||

| To Bank A/c | 6,000 | |||

| (Being insurance premium paid by cheque) | ||||

| Apr. 20 | Charity A/cDr. | 1,500 | ||

| To Purchases A/c | 1,500 | |||

| (Being goods given away as charity) | ||||

| Apr. 29 | Drawings A/cDr. | 5,000 | ||

| To Cash A/c | 5,000 | |||

| (Being cash withdrawn for personal use) | ||||

| Total | 2,33,500 | 2,33,500 |

Journal Entries for Goods and Services Tax (GST)

Goods and Services Tax (GST) is an indirect tax levied on the supply of goods and services. For accounting purposes, GST is categorized based on whether it is paid on purchases (Input GST) or collected on sales (Output GST).

GST Accounts

-

Input GST: Tax paid on purchases. It is treated as an Asset because it can be used to offset the tax collected on sales.

- Input CGST Account

- Input SGST Account

- Input IGST Account

-

Output GST: Tax collected on sales. It is treated as a Liability because it must be paid to the government.

- Output CGST Account

- Output SGST Account

- Output IGST Account

Types of GST based on Transaction Location

- Intra-State (within the same state): Both CGST (Central GST) and SGST (State GST) are applied.

- Inter-State (between two different states): Only IGST (Integrated GST) is applied.

GST Transaction 1: Intra-State Purchase of Goods

Transaction: On June 5, 2023, purchased goods for ₹1,00,000 from 'Local Suppliers' (within the same state) on credit. CGST @ 9% and SGST @ 9% were applied.

Detailed Analysis of the Transaction

When goods are purchased within the same state (intra-state), both Central GST (CGST) and State GST (SGST) are levied. The GST paid on purchases is called Input GST. It is treated as an asset because the business can later use this amount to reduce its GST liability on sales. The total amount owed to the supplier includes the cost of goods plus the GST paid.

-

Calculation:

Base Price of Goods = ₹ 1,00,000

Add: Input CGST = $9\% \text{ of ₹} 1,00,000 = \text{₹} 9,000$

Add: Input SGST = $9\% \text{ of } \text{₹} 1,00,000 = \text{₹} 9,000$

Total Invoice Value (Amount payable to Local Suppliers) = $\text{₹} 1,00,000 + \text{₹} 9,000 + \text{₹} 9,000 = \text{₹} 1,18,000$ -

Accounting Impact (The "Why" behind the entry):

1. Purchases A/c (Debit ₹1,00,000): Purchases are an expense for the business. According to the rules of accounting, an increase in expenses is recorded as a debit. Note that only the base price of the goods is considered an expense.

2. Input CGST A/c & Input SGST A/c (Debit ₹9,000 each): The GST paid is not an expense but an asset. It represents a claim that the business has against the government, which can be used to offset future tax collections. An increase in assets is recorded as a debit.

3. Local Suppliers A/c (Credit ₹1,18,000): Since the goods were bought on credit, 'Local Suppliers' become a creditor, which is a liability for the business. The liability is for the full invoice amount. An increase in liabilities is recorded as a credit.

Journal Entry

| Date | Particulars | L.F. | Debit Amount (₹) | Credit Amount (₹) |

|---|---|---|---|---|

| 2023 | ||||

| Jun. 05 | Purchases A/cDr. | 1,00,000 | ||

| Input CGST A/cDr. | 9,000 | |||

| Input SGST A/cDr. | 9,000 | |||

| To Local Suppliers A/c | 1,18,000 | |||

| (Being goods purchased on credit with CGST and SGST @ 9% each) |

GST Transaction 2: Inter-State Sale of Goods

Transaction: On June 20, 2023, sold goods for ₹1,50,000 to 'ABC Ltd.' of another state on credit. IGST @ 18% was applied.

Detailed Analysis of the Transaction

When goods are sold to a party in another state (inter-state), a single tax, Integrated GST (IGST), is levied. The GST collected on sales is called Output GST. This is a liability for the business because this amount has been collected from the customer on behalf of the government and must be paid to them.

-

Calculation:

Base Price of Goods (Revenue) = \text{₹} 1,50,000

Add: Output IGST = $18\% \text{ of } \text{₹} 1,50,000 = \text{₹} 27,000$

Total Invoice Value (Amount receivable from ABC Ltd.) = $\text{₹} 1,50,000 + \text{₹} 27,000 = \text{₹} 1,77,000$ -

Accounting Impact (The "Why" behind the entry):

1. ABC Ltd. A/c (Debit ₹1,77,000): ABC Ltd. is a debtor, which is an asset to the business. The company has the right to receive the full invoice value from them. An increase in assets (debtors) is recorded as a debit.

2. Sales A/c (Credit ₹1,50,000): Sales are revenue for the business. An increase in revenue is recorded as a credit. The company's revenue is only the base selling price of the goods, not the tax collected.

3. Output IGST A/c (Credit ₹27,000): The IGST collected creates a liability for the business, as it needs to be paid to the government. An increase in liabilities is recorded as a credit.

Journal Entry

| Date | Particulars | L.F. | Debit Amount (₹) | Credit Amount (₹) |

|---|---|---|---|---|

| 2023 | ||||

| Jun. 20 | ABC Ltd. A/cDr. | 1,77,000 | ||

| To Sales A/c | 1,50,000 | |||

| To Output IGST A/c | 27,000 | |||

| (Being goods sold on credit to another state with IGST @ 18%) |

GST Transaction 3: Set-off and Payment of GST

Transaction: On July 31, 2023, the GST liability for June is settled. Assume the only GST transactions were the two mentioned above and an intra-state sale which resulted in Output CGST of ₹12,000 and Output SGST of ₹12,000. The net GST liability is paid to the government via cheque.

Detailed Analysis of GST Settlement

At the end of a tax period, a business must settle its GST account. This involves using the Input GST (asset) it has paid to "set-off" or pay down the Output GST (liability) it has collected. The remaining balance of the liability is then paid to the government.

- Summarize GST Accounts: First, we total all the Input and Output GST collected and paid during the period.

- Total Input GST (Asset):

- Input CGST: ₹9,000

- Input SGST: ₹9,000

- Input IGST: ₹0

- Total Output GST (Liability):

- Output CGST: ₹12,000

- Output SGST: ₹12,000

- Output IGST: ₹27,000

- Total Input GST (Asset):

- Set-off Calculation: The Output GST liability is settled against the Input GST asset.

- Net CGST Payable = Output CGST - Input CGST = $\text{₹}12,000 - \text{₹}9,000 = \text{₹}3,000$

- Net SGST Payable = Output SGST - Input SGST = $\text{₹}12,000 - \text{₹}9,000 = \text{₹}3,000$

- Net IGST Payable = Output IGST - Input IGST = $\text{₹}27,000 - \text{₹}0 = \text{₹}27,000$

- Total GST to be paid to Government: $\text{₹}3,000 \text{ (CGST)} + \text{₹}3,000 \text{ (SGST)} + \text{₹}27,000 \text{ (IGST)} = \text{₹}33,000$.

- Accounting Impact (The "Why" behind the entry): The goal is to cancel the liability and asset accounts against each other and pay the difference.

1. Debit Output GST Accounts (₹27,000, ₹12,000, ₹12,000): The Output GST accounts have credit balances (as they are liabilities). To cancel or close these liabilities, we must debit them for their full amounts.

2. Credit Input GST Accounts (₹9,000, ₹9,000): The Input GST accounts have debit balances (as they are assets). To use up and close these assets, we must credit them for their full amounts.

3. Credit Bank Account (₹33,000): The difference between the total debits (total Output GST) and the credits to Input GST is the final amount owed. This payment reduces the Bank account (an asset), and a decrease in an asset is recorded as a credit.

Journal Entry

| Date | Particulars | L.F. | Debit Amount (₹) | Credit Amount (₹) |

|---|---|---|---|---|

| 2023 | ||||

| Jul. 31 | Output IGST A/cDr. | 27,000 | ||

| Output CGST A/cDr. | 12,000 | |||

| Output SGST A/cDr. | 12,000 | |||

| To Input CGST A/c | 9,000 | |||

| To Input SGST A/c | 9,000 | |||

| To Bank A/c | 33,000 | |||

| (Being GST liability set-off and balance paid to government) |

Question. Record necessary Journal entries for Suman of Bihar assuming CGST @ 9% and SGST @ 9%. All transactions are local (intra-state) unless specified otherwise.

(i) Bought goods ₹3,50,000 from Jharkhand (Inter-state).

(ii) Sold goods for ₹4,00,000 locally on credit.

(iii) Paid Insurance premium ₹30,000.

(iv) Bought furniture for office ₹50,000.

(v) Paid the balance amount of GST.

Answer:

Books of Suman

Journal

| Date | Particulars | L.F. | Debit Amount (₹) | Credit Amount (₹) |

|---|---|---|---|---|

| (i) | Purchases A/cDr. | 3,50,000 | ||

| Input IGST A/c ($18\% \text{ of } 3,50,000$)Dr. | 63,000 | |||

| To Bank Account/Creditor's A/c | 4,13,000 | |||

| (Being goods bought from another state and IGST paid) | ||||

| (ii) | Debtors A/cDr. | 4,72,000 | ||

| To Sales A/c | 4,00,000 | |||

| To Output CGST A/c ($9\% \text{ of } 4,00,000$) | 36,000 | |||

| To Output SGST A/c ($9\% \text{ of } 4,00,000$) | 36,000 | |||

| (Being goods sold locally on credit and GST collected) | ||||

| (iii) | Insurance Premium A/cDr. | 30,000 | ||

| Input CGST A/c ($9\% \text{ of } 30,000$)Dr. | 2,700 | |||

| Input SGST A/c ($9\% \text{ of } 30,000$)Dr. | 2,700 | |||

| To Bank A/c | 35,400 | |||

| (Being insurance premium paid and GST paid on it) | ||||

| (iv) | Furniture A/cDr. | 50,000 | ||

| Input CGST A/c ($9\% \text{ of } 50,000$)Dr. | 4,500 | |||

| Input SGST A/c ($9\% \text{ of } 50,000$)Dr. | 4,500 | |||

| To Bank Account/Creditor's A/c | 59,000 | |||

| (Being furniture bought for office and GST paid) | ||||

| (v) | Output CGST A/cDr. | 36,000 | ||

| Output SGST A/cDr. | 36,000 | |||

| To Input CGST A/c | 7,200 | |||

| To Input SGST A/c | 7,200 | |||

| To Input IGST A/c | 57,600 | |||

| (Being output GST set off against available input GST as per working note) |

Working Note: Calculation for GST Set-off and Payment

1. Calculation of Total Input and Output GST:

- Total Input GST Available (Asset):

- Input IGST (from transaction i) = ₹63,000

- Input CGST (from iii + iv) = ₹2,700 + ₹4,500 = ₹7,200

- Input SGST (from iii + iv) = ₹2,700 + ₹4,500 = ₹7,200

- Total Output GST Collected (Liability):

- Output CGST (from transaction ii) = ₹36,000

- Output SGST (from transaction ii) = ₹36,000

2. GST Set-off Procedure:

The Output GST liability is settled by using the available Input GST credit in the following order:

| Particulars | Output CGST (₹) | Output SGST (₹) | Input IGST (₹) |

|---|---|---|---|

| Liability/Credit before Set-off | 36,000 | 36,000 | 63,000 |

| Less: Set-off from Input CGST (₹7,200) | (7,200) | - | - |

| Less: Set-off from Input SGST (₹7,200) | - | (7,200) | - |

| Remaining Liability to be Settled | 28,800 | 28,800 | - |

| Less: Set-off from Input IGST | (28,800) | (28,800) | (57,600) |

| Net GST Payable / (Credit to Carry Forward) | Nil | Nil | (5,400) |

Conclusion: After setting off all liabilities, there is no GST to be paid to the government. Instead, there is a remaining Input IGST credit of ₹5,400 which will be carried forward to the next tax period.

Question. Record the necessary journal entries for Nexus Electronics of Mumbai (Maharashtra), assuming CGST @ 9% and SGST @ 9%. The following transactions took place during the month of August, 2023.

(i) Purchased goods worth ₹2,00,000 from 'Alpha Suppliers' in Delhi (Inter-state).

(ii) Sold goods for ₹5,00,000 on credit to 'Dynamic Tech' in Pune (Intra-state).

(iii) Sold goods for ₹1,50,000 to 'Global Exports' in Bengaluru (Inter-state).

(iv) Paid rent of ₹50,000 for the office premises in Mumbai by cheque.

(v) Purchased a new computer for office use for ₹80,000 from a local vendor in Mumbai.

(vi) Paid ₹40,000 for professional consultation to a firm in Chennai (Inter-state).

(vii) Paid the balance amount of GST to the government.

Answer:

Books of Nexus Electronics

Journal

| Date | Particulars | L.F. | Debit Amount (₹) | Credit Amount (₹) |

|---|---|---|---|---|

| (i) | Purchases A/cDr. | 2,00,000 | ||

| Input IGST A/c ($18\% \text{ of } 2,00,000$)Dr. | 36,000 | |||

| To Alpha Suppliers A/c | 2,36,000 | |||

| (Being goods purchased on credit from another state) | ||||

| (ii) | Dynamic Tech A/cDr. | 5,90,000 | ||

| To Sales A/c | 5,00,000 | |||

| To Output CGST A/c ($9\% \text{ of } 5,00,000$) | 45,000 | |||

| To Output SGST A/c ($9\% \text{ of } 5,00,000$) | 45,000 | |||

| (Being goods sold on credit within the state) | ||||

| (iii) | Global Exports A/cDr. | 1,77,000 | ||

| To Sales A/c | 1,50,000 | |||

| To Output IGST A/c ($18\% \text{ of } 1,50,000$) | 27,000 | |||

| (Being goods sold on credit to another state) | ||||

| (iv) | Rent A/cDr. | 50,000 | ||

| Input CGST A/c ($9\% \text{ of } 50,000$)Dr. | 4,500 | |||

| Input SGST A/c ($9\% \text{ of } 50,000$)Dr. | 4,500 | |||

| To Bank A/c | 59,000 | |||

| (Being rent paid via cheque) | ||||

| (v) | Office Equipment (Computer) A/cDr. | 80,000 | ||

| Input CGST A/c ($9\% \text{ of } 80,000$)Dr. | 7,200 | |||

| Input SGST A/c ($9\% \text{ of } 80,000$)Dr. | 7,200 | |||

| To Bank Account/Creditor's A/c | 94,400 | |||

| (Being computer purchased for office use) | ||||

| (vi) | Professional Fees A/cDr. | 40,000 | ||

| Input IGST A/c ($18\% \text{ of } 40,000$)Dr. | 7,200 | |||

| To Bank A/c | 47,200 | |||

| (Being professional fees paid) | ||||

| (vii) | Output IGST A/cDr. | 27,000 | ||

| Output CGST A/cDr. | 45,000 | |||

| Output SGST A/cDr. | 45,000 | |||

| To Input IGST A/c | 43,200 | |||

| To Input CGST A/c | 11,700 | |||

| To Input SGST A/c | 11,700 | |||

| To Bank A/c (Balancing Figure) | 50,400 | |||

| (Being GST liability set-off and balance paid to government) |

Working Note: Calculation for GST Set-off and Payment

1. Calculation of Total Input and Output GST:

- Total Input GST Available (Asset):

- Input IGST = ₹36,000 (from i) + ₹7,200 (from vi) = ₹43,200

- Input CGST = ₹4,500 (from iv) + ₹7,200 (from v) = ₹11,700

- Input SGST = ₹4,500 (from iv) + ₹7,200 (from v) = ₹11,700

- Total Output GST Collected (Liability):

- Output IGST (from transaction iii) = ₹27,000

- Output CGST (from transaction ii) = ₹45,000

- Output SGST (from transaction ii) = ₹45,000

2. GST Set-off Procedure and Final Payment Calculation:

The Output GST liability is settled by using the available Input GST credit in the prescribed order.

| Particulars | Output IGST (₹) | Output CGST (₹) | Output SGST (₹) |

|---|---|---|---|

| Liability before Set-off | 27,000 | 45,000 | 45,000 |

| Less: Set-off from Input IGST (Available: ₹43,200) | (27,000) | (16,200) | - |

| Less: Set-off from Input CGST (Available: ₹11,700) | - | (11,700) | - |

| Less: Set-off from Input SGST (Available: ₹11,700) | - | - | (11,700) |

| Net GST Payable | Nil | 17,100 | 33,300 |

Conclusion:

Total GST to be paid to the government = ₹17,100 (CGST) + ₹33,300 (SGST) = ₹50,400.

This amount is paid via Bank, as reflected in the final journal entry.

The Ledger

The Ledger is the principal book of the accounting system, often referred to as the 'King of all Books of Accounts'. It serves as the central repository for all financial transactions of a business, organized by account. While the journal records transactions chronologically, the ledger classifies and summarizes them under individual account heads, providing a complete record of all activities related to a specific asset, liability, capital, revenue, or expense.

Utility and Importance of the Ledger

The ledger is indispensable for any organization for several reasons:

-

Consolidated Information: It provides a complete, classified summary of all transactions related to a specific account in one place. This makes it easy to understand the cumulative effect of transactions on that account.

-

Quick Ascertainment of Balances: It allows a business to quickly determine the balance of any account at any point in time. For instance, management can instantly know the cash on hand, bank balance, amount owed by a specific customer (debtor), or amount owed to a specific supplier (creditor).

-

Foundation for Trial Balance: The balances from all ledger accounts are used to prepare the Trial Balance, which is a statement that checks the arithmetical accuracy of the posting process. Without a ledger, preparing a trial balance is impossible.

-

Basis for Financial Statements: The ledger provides the final balances needed to prepare the primary financial statements—the Income Statement (Trading and Profit & Loss Account) and the Balance Sheet. Revenue and expense account balances go into the Income Statement, while asset, liability, and capital account balances form the Balance Sheet.

-

Analytical View: Unlike the journal, which provides a chronological narrative, the ledger offers an analytical view of financial data, making it a powerful tool for management control and decision-making.

For ease of use, accounts in the ledger are typically arranged in a logical order, often following the sequence in which they appear in the financial statements. An index at the beginning of the ledger helps locate accounts quickly. Large organizations often use alphanumeric codes for accounts for efficient data processing.

Format of a Ledger Account

Each account in the ledger is presented in a standardized format, with two identical sides representing the debit and credit aspects.

Name of the Account

Dr. (Debit) Cr. (Credit)

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

Explanation of Ledger Account Columns:

- Date: Records the date of the transaction as mentioned in the journal.

- Particulars: This column explains the other account involved in the transaction. By convention:

- On the Debit (Dr.) side, the entry begins with "To" followed by the name of the account that was credited in the journal.

- On the Credit (Cr.) side, the entry begins with "By" followed by the name of the account that was debited in the journal.

- J.F. (Journal Folio): Records the page number of the journal where the original transaction is recorded. This creates a crucial audit trail, linking the ledger back to the journal.

- Amount: The monetary value of the transaction is recorded in this column.

Balancing of an Account

At the end of an accounting period (or whenever required), ledger accounts are balanced to find the net position. This process is crucial for preparing the trial balance.

Steps for Balancing:

- Total the amount columns of both the debit and credit sides separately on a rough sheet.

- Find the difference between the two totals. This difference is the 'balance' of the account.

- Write this difference on the side whose total is smaller, so that the totals of both sides become equal.

- In the 'Particulars' column for this entry, write "By Balance c/d" (carried down) if the entry is on the debit side, or "To Balance c/d" if it's on the credit side.

- Draw a double line below the equal totals to close the account for the period.

- Bring the closing balance down to the opposite side, below the double line. This becomes the opening balance for the next period. Write "To Balance b/d" (brought down) on the debit side or "By Balance b/d" on the credit side.

Distinction between Journal and Ledger

| Basis of Distinction | Journal | Ledger |

|---|---|---|

| Stage of Entry | It is the book of original entry or first entry. Transactions are recorded here first. | It is the book of second entry. Entries are posted here from the journal. |

| Order of Recording | Transactions are recorded in chronological order (date-wise). | Transactions are recorded in analytical order (grouped by account). |

| Objective | To record every business transaction as and when it occurs. | To ascertain the net effect of all transactions on a particular account. |

| Basis of Preparation | Prepared on the basis of source documents (e.g., invoices, receipts). | Prepared on the basis of the journal. |

| Process Name | The process of recording entries is called 'Journalising'. | The process of recording entries is called 'Posting'. |

| Final Position | It does not show the final position or balance of any account. | It shows the final balance of each account after all postings. |

| Legal Evidence | It is considered primary evidence in a court of law as it's the first authentic record. | It serves as secondary evidence, supporting the entries made from the journal. |

Classification Of Ledger Accounts

For the purpose of preparing financial statements, ledger accounts are broadly classified into two groups based on whether their balances are carried forward or closed at the end of the accounting year.

-

Permanent Accounts (Real and Personal Accounts):

- These include all accounts related to Assets, Liabilities, and Capital (e.g., Machinery A/c, Creditors A/c, Capital A/c).

- The balances in these accounts represent the financial position of the business. They do not get exhausted within a single accounting period.

- At the end of the year, their closing balances (Balance c/d) are carried forward to become the opening balances (Balance b/d) of the next year.

- These accounts and their balances appear in the Balance Sheet.

-

Temporary Accounts (Nominal Accounts):

- These include all accounts related to Revenues/Gains and Expenses/Losses for the current period (e.g., Sales A/c, Rent A/c, Salary A/c).

- Their purpose is to accumulate financial performance data for a specific accounting period.

- At the end of the year, these accounts are closed by transferring their balances to the Trading and Profit & Loss Account. This process resets their balances to zero, so they can start fresh in the next period.

- These accounts help in calculating the net profit or loss and appear in the Income Statement.

This classification is fundamental to the accounting process, as it dictates how each account is treated at the year-end and is crucial for the accurate preparation of financial statements.

Posting From Journal

Posting is the second and a crucial step in the accounting cycle. It is the process of methodically transferring the debit and credit items from the Journal (the book of primary entry) to their respective accounts in the Ledger (the principal book of accounts). While the journal presents a chronological record of all transactions, posting reorganizes this data into a classified, analytical format. This aggregation allows a business to see the complete history and current status of any specific account at a glance.

Posting is typically performed periodically, such as daily, weekly, or monthly, depending on the volume of transactions and the organization's requirement for up-to-date account information.

The Detailed Steps of Posting

The process of posting requires careful attention to detail to ensure accuracy. Each debit and credit in a journal entry must be transferred to the correct side of the correct ledger account.

-

Locate the Account to be Debited: Identify the account that was debited in the journal entry. Find this account in the ledger. If it is the first transaction affecting this account, a new account must be opened on a fresh page or space in the ledger.

-

Record the Entry on the Debit Side: On the debit (left) side of the located ledger account, perform the following actions:

-

Date: In the 'Date' column, write the date of the transaction as recorded in the journal.

-

Particulars: In the 'Particulars' column, write the name of the account that was credited in the journal entry. This is conventionally preceded by the word "To". This signifies that the benefit has been received *from* the account mentioned.

-

J.F. (Journal Folio): In the 'J.F.' column, write the page number of the journal from which the entry is being posted. This creates a cross-reference for easy verification.

-

Amount: In the 'Amount' column, enter the exact amount as shown in the debit column of the journal entry.

-

-

Locate the Account to be Credited: Now, identify the account that was credited in the same journal entry and locate it in the ledger.

-

Record the Entry on the Credit Side: On the credit (right) side of this ledger account, perform the following actions:

-

Date: Enter the same transaction date in the 'Date' column.

-

Particulars: In the 'Particulars' column, write the name of the account that was debited in the journal entry. This is conventionally preceded by the word "By". This signifies that a benefit has been given *to* the account mentioned.

-

J.F. (Journal Folio): Write the same journal page number in the 'J.F.' column.

-

Amount: Enter the exact amount from the credit column of the journal entry.

-

-

Complete Cross-Referencing in the Journal: As a final step to confirm that posting is complete for both aspects of the entry, go back to the journal. In the 'L.F.' (Ledger Folio) column, write the page numbers of the ledger accounts where the debit and credit items have been posted. This prevents omissions and double-posting.

Step-by-Step Journaling and Ledger Posting: Creative Canvas Co.

This example illustrates the accounting process for a new art supply store, "Creative Canvas Co.", for September 2023. We will record each transaction in the journal and immediately post it to the relevant ledger accounts to show how the ledger is built transaction-by-transaction.

Transaction 1: Business Commenced

September 01: Rohan started 'Creative Canvas Co.' by investing ₹2,50,000 cash.

Journal Entry

| Date | Particulars | L.F. | Debit Amount (₹) | Credit Amount (₹) |

|---|---|---|---|---|

| 2023 | ||||

| Sep. 01 | Cash A/cDr. | 2,50,000 | ||

| To Capital A/c | 2,50,000 | |||

| (Being business started with cash) |

Ledger Posting

This entry affects the Cash Account and the Capital Account.

Cash Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2023 | 2023 | ||||||

| Sep. 01 | To Capital A/c | 2,50,000 |

Capital Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2023 | 2023 | ||||||

| Sep. 01 | By Cash A/c | 2,50,000 |

Transaction 2: Cash Deposited into Bank

September 02: Deposited ₹2,00,000 cash into a newly opened bank account.

Journal Entry

| Date | Particulars | L.F. | Debit Amount (₹) | Credit Amount (₹) |

|---|---|---|---|---|

| 2023 | ||||

| Sep. 02 | Bank A/cDr. | 2,00,000 | ||

| To Cash A/c | 2,00,000 | |||

| (Being cash deposited into bank) |

Ledger Posting

This entry affects the Bank Account and updates the Cash Account.

Cash Account (Updated)

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2023 | 2023 | ||||||

| Sep. 01 | To Capital A/c | 2,50,000 | Sep. 02 | By Bank A/c | 2,00,000 |

Bank Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2023 | 2023 | ||||||

| Sep. 02 | To Cash A/c | 2,00,000 |

Transaction 3: Goods Purchased on Credit

September 05: Purchased art supplies (goods) from 'Artisan Suppliers' for ₹60,000 on credit.

Journal Entry

| Date | Particulars | L.F. | Debit Amount (₹) | Credit Amount (₹) |

|---|---|---|---|---|

| 2023 | ||||

| Sep. 05 | Purchases A/cDr. | 60,000 | ||

| To 'Artisan Suppliers' A/c | 60,000 | |||

| (Being goods purchased on credit) |

Ledger Posting

This entry affects the Purchases Account and the 'Artisan Suppliers' Account.

Purchases Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2023 | 2023 | ||||||

| Sep. 05 | To 'Artisan Suppliers' A/c | 60,000 |

'Artisan Suppliers' Account (Creditor)

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2023 | 2023 | ||||||

| Sep. 05 | By Purchases A/c | 60,000 |

Transaction 4: Goods Sold on Credit

September 10: Sold paintings to 'Gallery One' for ₹80,000 on credit.

Journal Entry

| Date | Particulars | L.F. | Debit Amount (₹) | Credit Amount (₹) |

|---|---|---|---|---|

| 2023 | ||||

| Sep. 10 | 'Gallery One' A/cDr. | 80,000 | ||

| To Sales A/c | 80,000 | |||

| (Being goods sold on credit) |

Ledger Posting

This entry affects the 'Gallery One' Account and the Sales Account.

'Gallery One' Account (Debtor)

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2023 | 2023 | ||||||

| Sep. 10 | To Sales A/c | 80,000 |

Sales Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2023 | 2023 | ||||||

| Sep. 10 | By 'Gallery One' A/c | 80,000 |

Transaction 5: Rent Paid by Cheque

September 15: Paid shop rent of ₹25,000 by cheque.

Journal Entry

| Date | Particulars | L.F. | Debit Amount (₹) | Credit Amount (₹) |

|---|---|---|---|---|

| 2023 | ||||

| Sep. 15 | Rent Expense A/cDr. | 25,000 | ||

| To Bank A/c | 25,000 | |||

| (Being rent paid by cheque) |

Ledger Posting

This entry affects the Rent Expense Account and updates the Bank Account.

Rent Expense Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2023 | 2023 | ||||||

| Sep. 15 | To Bank A/c | 25,000 |

Bank Account (Updated)

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2023 | 2023 | ||||||

| Sep. 02 | To Cash A/c | 2,00,000 | Sep. 15 | By Rent Expense A/c | 25,000 |

Transaction 6: Cash Received from Debtor

September 20: Received ₹50,000 cash from 'Gallery One'.

Journal Entry

| Date | Particulars | L.F. | Debit Amount (₹) | Credit Amount (₹) |

|---|---|---|---|---|

| 2023 | ||||

| Sep. 20 | Cash A/cDr. | 50,000 | ||

| To 'Gallery One' A/c | 50,000 | |||

| (Being cash received from debtor) |

Ledger Posting

This entry updates the Cash Account and the 'Gallery One' Account.

Cash Account (Updated)

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2023 | 2023 | ||||||

| Sep. 01 | To Capital A/c | 2,50,000 | Sep. 02 | By Bank A/c | 2,00,000 | ||

| Sep. 20 | To 'Gallery One' A/c | 50,000 |

'Gallery One' Account (Updated)

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2023 | 2023 | ||||||

| Sep. 10 | To Sales A/c | 80,000 | Sep. 20 | By Cash A/c | 50,000 |

Transaction 7: Payment to Creditor with Discount

September 22: Paid 'Artisan Suppliers' ₹59,500 by cheque in full settlement of their account of ₹60,000.

Journal Entry

| Date | Particulars | L.F. | Debit Amount (₹) | Credit Amount (₹) |

|---|---|---|---|---|

| 2023 | ||||

| Sep. 22 | 'Artisan Suppliers' A/cDr. | 60,000 | ||

| To Bank A/c | 59,500 | |||

| To Discount Received A/c | 500 | |||

| (Being payment made in full settlement and discount received) |

Ledger Posting

This entry affects the 'Artisan Suppliers' Account, the Bank Account, and the Discount Received Account.

'Artisan Suppliers' Account (Updated)

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2023 | 2023 | ||||||

| Sep. 22 | To Bank A/c | 59,500 | Sep. 05 | By Purchases A/c | 60,000 | ||

| Sep. 22 | To Discount Received A/c | 500 |

Note: The total debits (₹60,000) now equal the total credits (₹60,000), so the account is settled.

Bank Account (Updated)

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2023 | 2023 | ||||||

| Sep. 02 | To Cash A/c | 2,00,000 | Sep. 15 | By Rent Expense A/c | 25,000 | ||

| Sep. 22 | By 'Artisan Suppliers' A/c | 59,500 |

Discount Received Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2023 | 2023 | ||||||

| Sep. 22 | By 'Artisan Suppliers' A/c | 500 |

Transaction 8: Goods Withdrawn for Personal Use

September 25: Rohan took goods worth ₹3,000 for his personal use.

Journal Entry

| Date | Particulars | L.F. | Debit Amount (₹) | Credit Amount (₹) |

|---|---|---|---|---|

| 2023 | ||||

| Sep. 25 | Drawings A/cDr. | 3,000 | ||

| To Purchases A/c | 3,000 | |||

| (Being goods withdrawn for personal use) |

Ledger Posting

This entry affects the Drawings Account and the Purchases Account.

Drawings Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2023 | 2023 | ||||||

| Sep. 25 | To Purchases A/c | 3,000 |

Purchases Account (Updated)

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2023 | 2023 | ||||||

| Sep. 05 | To 'Artisan Suppliers' A/c | 60,000 | Sep. 25 | By Drawings A/c | 3,000 |

Transaction 9: Cash Sales

September 28: Sold goods for ₹12,000 cash.

Journal Entry

| Date | Particulars | L.F. | Debit Amount (₹) | Credit Amount (₹) |

|---|---|---|---|---|

| 2023 | ||||

| Sep. 28 | Cash A/cDr. | 12,000 | ||

| To Sales A/c | 12,000 | |||

| (Being goods sold for cash) |

Ledger Posting

This entry updates the Cash Account and the Sales Account.

Cash Account (Updated)

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2023 | 2023 | ||||||

| Sep. 01 | To Capital A/c | 2,50,000 | Sep. 02 | By Bank A/c | 2,00,000 | ||

| Sep. 20 | To 'Gallery One' A/c | 50,000 | |||||

| Sep. 28 | To Sales A/c | 12,000 |

Sales Account (Updated)

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2023 | 2023 | ||||||

| Sep. 10 | By 'Gallery One' A/c | 80,000 | |||||

| Sep. 28 | By Cash A/c | 12,000 |

Transaction 10: Payment of Salaries

September 30: Paid salaries for the month, ₹18,000, in cash.

Journal Entry

| Date | Particulars | L.F. | Debit Amount (₹) | Credit Amount (₹) |

|---|---|---|---|---|

| 2023 | ||||

| Sep. 30 | Salaries Expense A/cDr. | 18,000 | ||

| To Cash A/c | 18,000 | |||

| (Being salaries paid in cash) |

Ledger Posting

This entry affects the Salaries Expense Account and updates the Cash Account.

Salaries Expense Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2023 | 2023 | ||||||

| Sep. 30 | To Cash A/c | 18,000 |

Cash Account (Updated)

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2023 | 2023 | ||||||

| Sep. 01 | To Capital A/c | 2,50,000 | Sep. 02 | By Bank A/c | 2,00,000 | ||

| Sep. 20 | To 'Gallery One' A/c | 50,000 | Sep. 30 | By Salaries Expense A/c | 18,000 | ||

| Sep. 28 | To Sales A/c | 12,000 |

Final and Balanced Ledger Accounts - As on September 30, 2023

Below are the completed ledger accounts. The process of balancing involves totaling both sides, finding the difference, placing that difference on the smaller side as "Balance c/d" (carried down), and then bringing that balance down to the correct side as "Balance b/d" (brought down) for the start of the next period (October 01).

Cash Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2023 | 2023 | ||||||

| Sep. 01 | To Capital A/c | 2,50,000 | Sep. 02 | By Bank A/c | 2,00,000 | ||

| Sep. 20 | To 'Gallery One' A/c | 50,000 | Sep. 30 | By Salaries Expense A/c | 18,000 | ||

| Sep. 28 | To Sales A/c | 12,000 | Sep. 30 | By Balance c/d | 94,000 | ||

| 3,12,000 | 3,12,000 | ||||||

| 2023 | 2023 | ||||||

| Oct. 01 | To Balance b/d | 94,000 |

Capital Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2023 | 2023 | ||||||

| Sep. 30 | To Balance c/d | 2,50,000 | Sep. 01 | By Cash A/c | 2,50,000 | ||

| 2,50,000 | 2,50,000 | ||||||

| 2023 | 2023 | ||||||

| Oct. 01 | By Balance b/d | 2,50,000 |

Bank Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2023 | 2023 | ||||||

| Sep. 02 | To Cash A/c | 2,00,000 | Sep. 15 | By Rent Expense A/c | 25,000 | ||

| Sep. 22 | By 'Artisan Suppliers' A/c | 59,500 | |||||

| Sep. 30 | By Balance c/d | 1,15,500 | |||||

| 2,00,000 | 2,00,000 | ||||||

| 2023 | 2023 | ||||||

| Oct. 01 | To Balance b/d | 1,15,500 |

Purchases Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2023 | 2023 | ||||||

| Sep. 05 | To 'Artisan Suppliers' A/c | 60,000 | Sep. 25 | By Drawings A/c | 3,000 | ||

| Sep. 30 | By Balance c/d | 57,000 | |||||

| 60,000 | 60,000 | ||||||

| 2023 | 2023 | ||||||

| Oct. 01 | To Balance b/d | 57,000 |

'Artisan Suppliers' Account (Creditor)

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2023 | 2023 | ||||||

| Sep. 22 | To Bank A/c | 59,500 | Sep. 05 | By Purchases A/c | 60,000 | ||

| Sep. 22 | To Discount Received A/c | 500 | |||||

| 60,000 | 60,000 |

'Gallery One' Account (Debtor)

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2023 | 2023 | ||||||

| Sep. 10 | To Sales A/c | 80,000 | Sep. 20 | By Cash A/c | 50,000 | ||

| Sep. 30 | By Balance c/d | 30,000 | |||||

| 80,000 | 80,000 | ||||||

| 2023 | 2023 | ||||||

| Oct. 01 | To Balance b/d | 30,000 |

Sales Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2023 | 2023 | ||||||

| Sep. 30 | To Balance c/d (Transfer to P&L A/c) | 92,000 | Sep. 10 | By 'Gallery One' A/c | 80,000 | ||

| Sep. 28 | By Cash A/c | 12,000 | |||||

| 92,000 | 92,000 |

Note: As a nominal (revenue) account, the balance of the Sales Account is typically transferred to the Profit & Loss Account at year-end, not carried down. The balancing shown here is for illustrative purposes.

Rent Expense Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2023 | 2023 | ||||||

| Sep. 15 | To Bank A/c | 25,000 | Sep. 30 | By Balance c/d (Transfer to P&L A/c) | 25,000 | ||

| 25,000 | 25,000 |

Discount Received Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2023 | 2023 | ||||||

| Sep. 30 | To Balance c/d (Transfer to P&L A/c) | 500 | Sep. 22 | By 'Artisan Suppliers' A/c | 500 | ||

| 500 | 500 |

Drawings Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2023 | 2023 | ||||||

| Sep. 25 | To Purchases A/c | 3,000 | Sep. 30 | By Balance c/d (Transfer to Capital A/c) | 3,000 | ||

| 3,000 | 3,000 |

Salaries Expense Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2023 | 2023 | ||||||

| Sep. 30 | To Cash A/c | 18,000 | Sep. 30 | By Balance c/d (Transfer to P&L A/c) | 18,000 | ||

| 18,000 | 18,000 |

Comprehensive Posting Example

Let's consider the following transactions for a new business, 'Elegant Furnishings', for the month of July 2023 and post them to the ledger.

Journal of Elegant Furnishings

| Date | Particulars | L.F. | Debit Amount (₹) | Credit Amount (₹) |

|---|---|---|---|---|

| 2023 | ||||

| Jul. 01 | Cash A/cDr. | 2,00,000 | ||

| To Capital A/c | 2,00,000 | |||

| (Being business started with cash) | ||||

| Jul. 03 | Bank A/cDr. | 1,50,000 | ||

| To Cash A/c | 1,50,000 | |||

| (Being cash deposited into bank) | ||||

| Jul. 05 | Purchases A/cDr. | 50,000 | ||

| To 'Supreme Woods' A/c | 50,000 | |||

| (Being goods purchased on credit) | ||||

| Jul. 10 | Furniture A/cDr. | 25,000 | ||

| To Bank A/c | 25,000 | |||

| (Being office furniture purchased) | ||||

| Jul. 15 | Riya Traders A/cDr. | 30,000 | ||

| To Sales A/c | 30,000 | |||

| (Being goods sold on credit) | ||||

| Jul. 20 | 'Supreme Woods' A/cDr. | 50,000 | ||

| To Bank A/c | 49,500 | |||

| To Discount Received A/c | 500 | |||

| (Being payment made in full settlement) | ||||

| Jul. 25 | Cash A/cDr. | 29,000 | ||

| Discount Allowed A/cDr. | 1,000 | |||

| To Riya Traders A/c | 30,000 | |||

| (Being cash received in full settlement) | ||||

| Jul. 31 | Salaries A/cDr. | 12,000 | ||

| To Cash A/c | 12,000 | |||

| (Being salaries paid for the month) |

Ledger Posting for Elegant Furnishings

Cash Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2023 | 2023 | ||||||

| Jul. 01 | To Capital A/c | 2,00,000 | Jul. 03 | By Bank A/c | 1,50,000 | ||

| Jul. 25 | To Riya Traders A/c | 29,000 | Jul. 31 | By Salaries A/c | 12,000 |

Capital Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2023 | 2023 | ||||||

| Jul. 01 | By Cash A/c | 2,00,000 |

Bank Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2023 | 2023 | ||||||

| Jul. 03 | To Cash A/c | 1,50,000 | Jul. 10 | By Furniture A/c | 25,000 | ||

| Jul. 20 | By 'Supreme Woods' A/c | 49,500 |

Purchases Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2023 | 2023 | ||||||

| Jul. 05 | To 'Supreme Woods' A/c | 50,000 |

'Supreme Woods' Account (Creditor)

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2023 | 2023 | ||||||

| Jul. 20 | To Bank A/c | 49,500 | Jul. 05 | By Purchases A/c | 50,000 | ||

| Jul. 20 | To Discount Received A/c | 500 |

Furniture Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2023 | 2023 | ||||||

| Jul. 10 | To Bank A/c | 25,000 |

Riya Traders Account (Debtor)

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |

|---|---|---|---|---|---|---|---|

| 2023 | 2023 | ||||||

| Jul. 15 | To Sales A/c | 30,000 | Jul. 25 | By Cash A/c | 29,000 | ||

| Jul. 25 | By Discount Allowed A/c | 1,000 |

Sales Account

Dr.Cr.

| Date | Particulars | J.F. | Amount (₹) | Date | Particulars | J.F. | Amount (₹) |